Expanding your quick-service brand abroad? Then you’d best forget what you know about the American market.

While quick-service restaurants span the globe, the dining habits of consumers outside the United States—such as the hours at which they prefer to dine and the frequency with which they visit—are as different as the languages they speak.

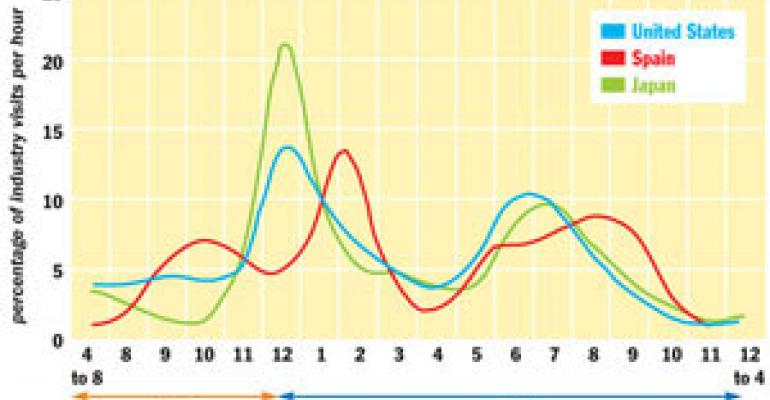

New data from market research firm The NPD Group reveal that what differentiates U.S. restaurant consumers from those in other countries isn’t so much about what they eat, but when they eat.

“Knowing the American market doesn’t help when you go elsewhere,” said Bob O’Brien, president of global foodservice development for Port Washington, N.Y.-based NPD. “These habits do not translate from country to country.… Pieces of them do translate in their own way.”

All in the timing Americans, it seems, are always eating. According to NPD, U.S. consumers visit restaurants at all hours of the day for everything from main meals to late-night snacks. However, the bulk of traffic occurs during lunch and dinner. In the year ended June 2006, peak traffic times at U.S. commercial restaurants were noon, with 14 percent of visits, and 6 p.m., with 10 percent of visits. “These habits…[show that Americans] do depend a lot on frequent quick, small meals,” O’Brien said. “You can see in Northern Europe they don’t have that habit.” Although the Japanese live on the other side of the world, their dining habits are similar to those of Americans. Like Americans, the Japanese visit restaurants at all hours of the day with peak traffic times occurring during lunch and dinner. However, the data reveal that the Japanese do not use restaurants for morning meal to the extent that Americans do. Instead, there is a much heavier emphasis on lunch. In the year ended June 2006, 21 percent of visits to commercial restaurants in Japan occurred at noon. During the same period, 7 p.m., when the Japanese tend to eat dinner, accounted for 10 percent of visits. The restaurant business in Germany is a main-meal business. Germans stop by to eat lunch and dinner, but rarely visit restaurants for breakfast or snacks. In the year ended June 2006, peak hours were noon, with 16 percent of visits, and 7 p.m., with 14 percent of visits. There was almost no traffic during the morning meal or late-night periods. “This is not the way restaurants are used in Germany,” O’Brien said of the country’s lack of morning meal and snack business. “Someone wanting to grow that way…they’re going to have to change the market.” Like the Germans, the English visit restaurants primarily for lunch and dinner, and rarely for morning meals or snacks. In the year ended June 2006, peak hours in Great Britain were 1 p.m., with 17 percent of traffic, and 7 p.m., with 13 percent of traffic. Lunch is by far the biggest day-part for the French. In the year ended June 2006, noon accounted for 25 percent of visits. The French also visit restaurants for dinner and snacks. During the same period, 9 percent of visits occurred at the 8 p.m. dinner hour, and about 7 percent of visits occurred between 3 p.m. and 6 p.m., when the French sometimes grab a late-afternoon aperitif or coffee. “They really just like eating at home,” O’Brien said of the French. Canadians visit restaurants for morning meals and snacks more than any other country and have the earliest dinner. In the year ended May 2006, morning meal traffic began at 4 a.m. and steadily increased to about 6 percent by 10 a.m., then dipped slightly around 11 a.m. Dinner, which occurs at the early hour of 6 p.m. in Canada, accounted for 15 percent of traffic. “[Canada] has a much higher developed a.m. snack business than anywhere else,” O’Brien said. “It somehow replaces lunch.” When it comes to eating hours, Spain is like no other country in the world. Spaniards fill area cafes midmorning during a “mandatory” 10 a.m. coffee break to hold them over until lunch around 2 p.m., NPD found. Then they grab a light bite around 6 p.m. so they can make it until dinner at 9 p.m. or 10 p.m. Though peak hours at commercial Spanish restaurants in the year ended June 2006 were 2 p.m., with 14 percent of traffic, and 9 p.m., with 9 percent of traffic, Spain has a relatively even distribution of traffic across all day-parts. Money matters The countries with the highest usage rates—Great Britain, France, Germany and the United States—also have the highest average eater checks, NPD found. The data also reveal that Americans spend only 10 percent of their disposable income on food, compared with the 20 percent to 25 percent spent by continental Europeans. O’Brien attributed the high percentage of income spent on food in Europe to the higher cost of food and Europeans’ propensity to use restaurants primarily for main meals. “It’s just a more expensive thing [in Europe],” O’Brien said. “So they expect more from it, too.” Despite the high cost of food, deals and promotions are not big in most European countries. The United States and Germany have the most aggressive use of deals and promotions. During the year ended June 2006, 26 percent of all visits to quick-service restaurants in Germany included a deal and/or promotion and 24 percent of all visits to quick-service restaurants in the United States included a deal and/or promotion. By contrast, just 12 percent of customer visits in France included a deal and/or promotion, while 5 percent in Great Britain did and 2 percent in Spain did. Going local, staying true To translate its brand abroad, Dallas-based Pizza Hut, which currently operates nearly 5,000 units outside of North America, adapts and augments its classic pizza menu to meet the needs of local consumers. “Pizza Hut pays a lot of attention to local tastes, and pizza is the ultimate platform to meet these different tastes,” said spokesman Christophe LeCureuil. The pizza chain localizes its menu by topping pizzas or modifying favorite sides with regional ingredients, LeCureuil said. For example, Pizza Hut customers in Hong Kong can get their pies topped with shrimp, octopus and squid, while customers in India can order a range of tandoori pizzas. The chain’s popular Cheesey Bites pizza is now available in more than 20 countries with more than 20 different adaptations ranging from shrimp in Korea to a triple-cheese blend in Great Britain. The chain, which is largely dine-in abroad, also offers options such as special lunch buffets and appetizers and starters that cater to local dining habits. In France, where consumers visit restaurants most at lunchtime, Pizza Hut offers a special all-you-caneat buffet that includes a variety of vegetables and/or pizzas. Europeans, who tend to prefer dining in and lingering, can extend their lunch or dinner experience with starters such as breadsticks and pastas as well as dessert. Asians are getting a taste of the chain’s new “tea time” menu featuring tea, coffee and sweets, currently being tested across Asia. For Carpinteria, Calif.-based CKE Restaurants, which operates the Carl’s Jr. and Hardee’s brands, a large part of appealing to international consumers is about modifying the marketing, not the menu. “We’re not involved in wholesale menu changes but have adjusted menu items,” said Ned Lyerly, CKE senior vice president of global franchise development. “We adapt our communications and our messaging in a market to our target.” CKE, which has 265 international units in locations such as Mexico and the Middle East, still markets to Carl’s Jr.’s core premium burger products, but the approach varies from market to market. For example, Lyerly said, in the United States advertisements for Carl’s Jr. tend to be edgy and controversial, but going into markets such as the Middle East and Singapore requires some toning down. Although CKE stays true to its brand in every market, the company has made some menu alterations to meet local tastes, such as offering rice bowls in lieu of French fries at Hardee’s in Asia. The company is currently in the process of expanding Carl’s Jr. to Europe by way of Ireland and Canada, where consumers use restaurants heavily for morning meals and snacks. “Many view Canada as an extension of the U.S., but it’s different,” Lyerly said. “There won’t be any major fundamental changes…but we’ll make sure we strengthen our breakfast menu.”