Throughout the past three quarters, we’ve taken a look at which fast casual, casual and fine dining brands perform the best according to customers as part of The Happy Customer Index. The index leverages Merchant Centric’s proprietary data, which analyzes content from millions of reviews across sites like Google and TripAdvisor to identify insights on over 100 key metrics, such as food, cleanliness, staff demeanor, and value.

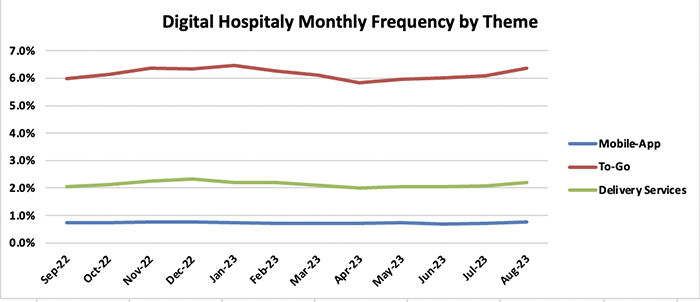

This time around, we’re taking a look at the digitally-enabled off-premises business, as it remains elevated after an abrupt, pandemic-induced shift. To better understand digital guests’ satisfaction, Merchant Centric examined reviews mentioning “to go,” “delivery” and “mobile apps,” which included over 1.25 million reviews from September 2022 to August 2023.

What have we learned?

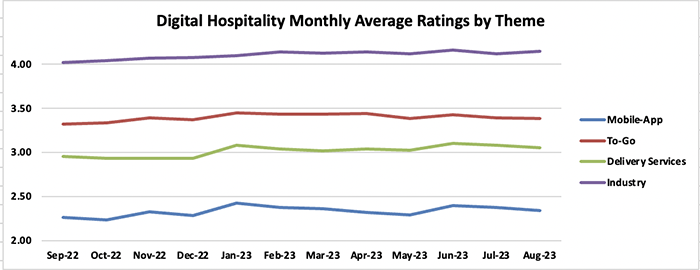

“Guests tell us that the digital experience is not nearly as good as dining in; generally, about three quarters of a star to a full star lower,” said Merchant Centric Co-Founder Adam Leff. “However, delivery services have been closing the gap on the to-go experience, improving at a faster rate. Mobile app mentions do not necessarily refer to offsite ordering but are mentioned the least and fare the worst.”

Notably, the average ratings for these digitally related themes are lower than all reviews by about 60-to-70 basis points. Consider:

- The average rating for reviews mentioning “mobile apps” is 2.33 stars out of 5 stars.

- The average rating for reviews mentioning “delivery services” is 3.02 stars out of 5 stars.

- The average rating of reviews mentioning “to go” is 3.40 stars out of 5 stars.

By comparison, the restaurant industry average rating during the same period is 4.11 out of 5 stars.

The mobile app experience

The biggest disparity between dine-in and digital mentions in reviews came from mobile app experiences. Low ratings for apps come as more brands double down on their mobile presence to drive traffic and frequency, whether by updating their loyalty programs, offering exclusive deals, incentivizing digital orders and more. The benefits extend to operators, as well, providing deeper consumer insights and the ability to better personalize messaging. But because consumers have become so mobile dependent, any subpar experience can lead to frustration. Taco Bell, for instance, generates 32% of Reddit conversations among the top 10 quick-service restaurants – far more than its peers – but conversations have predominantly focused on dissatisfaction with the brand’s app, including order inaccuracies, glitches, and usability challenges.

That said, there has been improvement for mobile app performances (10 basis points) based on customers’ reviews, as well as for to-go and delivery experiences. Overall, to-go fared the best among reviews and was mentioned the most, though delivery improved the most (14 basis points) throughout the past year.

That said, there has been improvement for mobile app performances (10 basis points) based on customers’ reviews, as well as for to-go and delivery experiences. Overall, to-go fared the best among reviews and was mentioned the most, though delivery improved the most (14 basis points) throughout the past year.

Leff believes the improvement within the delivery channel is attributable in part to brands’ increased focus on their digital business – redistributing labor to digital makelines, for instance, or adding features like pickup shelves, or location-based or sequencing technology.

“It is no surprise there is a gap between dine-in and to-go/delivery. People just expect that when they don’t have the dine-in service or hospitality, it will not be as good,” Leff said. “To a large degree, they’re forgiving because of this. The important thing is we’re seeing steady improvement in overall (digital) guest satisfaction.”

“It is no surprise there is a gap between dine-in and to-go/delivery. People just expect that when they don’t have the dine-in service or hospitality, it will not be as good,” Leff said. “To a large degree, they’re forgiving because of this. The important thing is we’re seeing steady improvement in overall (digital) guest satisfaction.”

Special note: All data and analytics presented in this article are based upon Merchant Centric’s findings and, like all data sets, are inherently limited in scope and nature. Data presented herein may not be comprehensive and may exclude certain brands or brand locations. Data is provided without guarantee as to its accuracy, completeness, or currency, and Merchant Centric expressly disclaims any and all liability resulting from reliance on information or opinions included herein.

Contact Alicia Kelso at [email protected]