Even as outposts of locally known restaurants continue to open at a brisk pace in airports nationwide, concessionaires say luring independent operators into such branding deals is no easy task.

While airport locations can lead to new revenue streams and increased exposure for local operators, they also require a willingness to share operational control with concessionaires who are better able to handle the higher startup costs and stringent security measures at air terminals.

“Local restaurateurs need to get comfortable with our ability to duplicate what they’ve worked on their entire life, understand that we can build it, operate it and make money [at the airport],” said Laura Alphran, director of business development for Buffalo, N.Y.-based Delaware North Cos.’ Travel and Hospitality division.

Still, several well-known chefs and restaurateurs, including Kathy Casey, David Wilhelm, and Joseph and Paul Bartolotta, are signing contracts with such master concessionaires as HMSHost Corp., Delaware North Cos. and SSP America, formerly known as Creative Host.

The trend of bringing local concepts to airports hit its stride after the Sept. 11, 2001, terrorist attacks. Given increased security measures, travelers were forced to arrive at airports earlier, increasing dwell times and demand for more and better eating options, said Todd Cavallaro, director of markets for Philadelphia-based airport concessionaire OTG Management.

“Because people come to the airport much earlier and spend more time there, we’re trying to get them to want to go to the airport instead of feeling like they have to,” he said. “Bringing street concepts in has been groundbreaking. More people are aware there are good choices.”

In addition, Steve Van Beek, director of the Washington, D.C.-based Jacobs Consultancy, said: “We are seeing more airports taking a little bit more control of the offerings and their percentages of profits. There’s a tendency to bring in more national and local brands as a way to provide more options for customers and generate more revenues for themselves.”

Select Service Partners and its U.S. arm, Creative Host, which were spun off from Britain’s Compass Group PLC and sold to private-equity firm EQT Partners for approximately $3.17 billion in 2006, recently began making a push into North America under the new SSP America name, led by chief executive Les Cappetta, formerly vice president of business development for HMSHost. Cappetta joined SSP last June and already has struck deals at New York’s JFK International Airport, Milwaukee’s Mitchell Field and North Carolina’s Raleigh-Durham International Airport, where he plans to open several high-end local restaurants. Milwaukee-based Alterra Coffee Roasters and the Wauwatosa, Wis.-based Bartolotta Restaurant Group’s Ristorante Italiano concept both are scheduled to open at Mitchell Field this year.

The Bartolottas have a licensing agreement with SSP, said John Wyse, the restaurant group’s director of operations.

“[SSP will] own and operate it,” Wyse said, “but our name, recipes and expertise are involved in maintaining the quality of the restaurant, which will combine sit down and a menu featuring pizza, pasta and other Italian foods, as well as a quick-serve pizza counter and gelato concept.”

Delaware North’s Alphran said the cost of operating in an airport is prohibitive, a big reason why local restaurateurs find it difficult to open stores there independently.

“The investment to build out is one to one-and-a-half times [more] than a street location, and the occupancy rents are two times higher than on the street,” she said. “You’ve got badging, three-shift operations and post-security locations that are more expensive because you’ve got to get your equipment through the security. And sometimes you have to deal with unions. Also, distribution costs are more expensive.”

Much research goes into selecting local candidates, Alphran said.

“It can take several months, and it’s not always as simple as saying, ‘I like that brand,’” she said. “I have to sit with the owner and talk about why [the concept] should be in that particular airport and how much revenue it could generate. It’s a huge selling job because [the operators] are so passionate about their concepts.”

David Wilhelm, president and chief executive of Newport Beach, Calif.-based Culinary Adventures, which operates such restaurants as French 75, Sorrento Grille and Savannah, was hesitant when HMSHost first approached him in 2005 to create Oasis Grill & Sky Lounge for John Wayne Airport in Orange County.

“Initially, I didn’t jump at it,” he said. “We had numerous conversations, and they were very receptive to allowing me to use the location to cross-market my other restaurants in Southern California. The largest single benefit is the exposure to your brand or brands. Close to 10 million travelers go through the airport each year. That’s a lot of exposure.”

Once a deal is struck, concessionaires tend to offer licensing deals that are much like franchising agreements, allowing contractors to manage the brands, use the operators’ names and recipes, and trade on their street reputations.

“A royalty fee is paid yearly and is a percent of sales on an annual basis,” she said. “For local concepts that fee can be anywhere from 2 [percent] to 4 percent and sometimes 5 [percent]. It depends on how strong the recognition for the brand is in that market. Usually, it’s not as high as the national brands [get] because they don’t have the same recognition factor.”

Casey, whose Seattle-based Dish D’Lish concept is located at SeaTac International Airport, calls her four-year-old licensing agreement with HMSHost a positive experience. She added that she would like to open locations in other airports across the country.

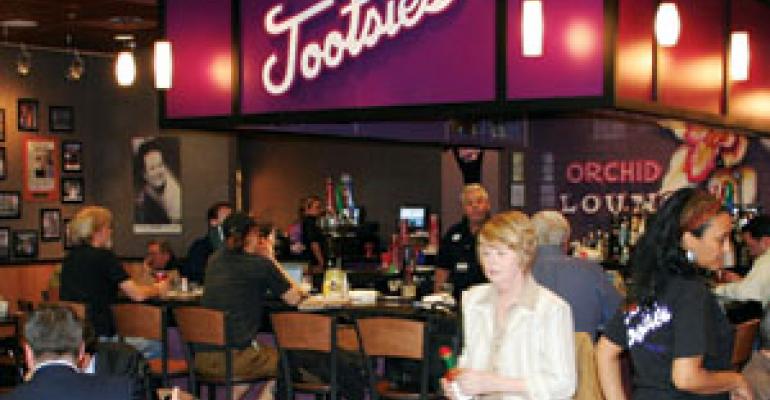

But Alphran, whose latest openings for Delaware North are two outposts of Tootsies Bar & Grill at Nashville International Airport, said that can be difficult.

“It’s not easy to translate into another market, especially the bigger ones, because they have their own regional brands that are important to them,” she said.