Restaurants that have never been shy about offering meal discounts to drive traffic are growing even bolder as they compete for dollars that consumers don’t want to give up easily in bad economic times.

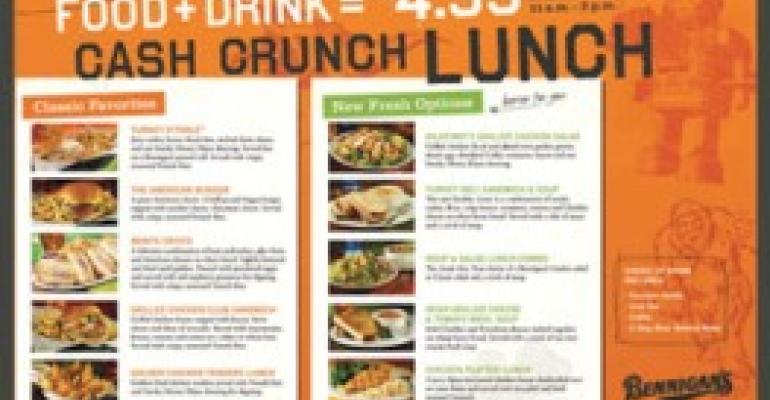

Promotions now bear such themes as B.R. Guest Restaurants’ “The Economy Stinks” or Bennigan’s Grill & Tavern’s “Cash Crunch Lunch.” Then there’s Subway’s labeling of its $5 promotion of foot-long subs as an “enticing economic package.”

Such imagery makes it clear that restaurant marketers know consumers feel strapped for cash and look for competitors to provide them with cheap eats just to get them in the door.

Pizza Hut and Domino’s have been waging a fierce deep-discount battle to generate business, with Pizza Hut contending that its Pizza Mia deal—12-inch, one-topping pies for $5 with the purchase of three or more—is a better value than Domino’s 444 Deal: three 10-inch pizzas for $4 each.

Deep discounts, however, are not appropriate for all brands, especially higher-end restaurants. When such restaurants cut prices drastically, consumers tend to think the food quality has gone down as well, and that drives them away, restaurant executives agree.

Restaurants that do offer deep discounts can’t afford to do so for too long, because eventually customers will grow bored with the same offer, says Dan Dahlen, executive vice president of the restaurant business group of IAG Research, a New York-based firm that tracks ad effectiveness.

“Four to eight weeks would be the average window space,” he says. “If you’re not coming out with new news, even another discount, [the offer] is going to get stale.”

Other factors make prolonged discounts difficult these days, what with margins being squeezed by soaring food commodity inflation.

B.R. Guest’s promotion ran only a week and offered 20 percent off the online purchase of gift cards.

Bennigan’s lunch program is a two-month promotion, running through June 16. It offers a meal with a drink for as low as $4.99 and features such choices from its Classic Favorites menu as Turkey O’ Toole and new menu items, including Irish Grilled Cheese & Tomato Basil Soup.

That promotion has driven customer counts higher since it began April 14, says Jennifer Gamble, senior marketing manager for Bennigan’s, a 310-plus-unit division of Plano, Texas-based Metro-media Restaurant Group.

“This is a huge opportunity to increase business in this economy,” she says. “Everyone’s watching their wallets these days.”

Because they are, more consumers are choosing to eat at quick-service restaurants, where prices generally are lower than at casual-dining chains.

To counter that, the Cash Crunch Lunch was priced to compete directly with the price of QSR combo meals, and Bennigan’s discount deal is pitched as a better-quality meal, Gamble says.

The lunch offer is a hook to snag first-time customers and turn them into frequent diners, she says.

Irvine, Calif.-based Wienerschnitzel also has its eye on building traffic with discount deals. It conducted a “5 for $4” promotion in February and came back with a “5 for $5” chili dog program in March, which “worked extremely well,” says Tom Amberger, vice president of marketing for parent company Galardi Group.

“With the way things are with the economy, you’ve just got to speak value,” he says. “You’ve got to get [customers] into the store. That’s what we’re focusing on right now. Hopefully, when the economy gets better we can introduce full-price new products.”

The 380-unit chain will repeat the “5 for $5” promotion in June. It’s a particularly good way to target 18-to-29-year-olds, who want “a lot of food for good value,” Amberger says.

“They also like customization, picking a combination of things they like,” he says.

The price level is low enough to provide value to the diner and high enough to benefit store operators, he says.

“It’s not like offering something for 79 cents,” Amberger says. “The consumer is buying $5 worth of product. The operator can upsell and increase the check average even more. The good ones do a good job of upselling.”

The Common Man multiconcept restaurant company, based in Ashland, N.H., recently launched a variety of “budget-friendly” programs at its 13 units, which include Common Man, Tilt’n Diner, Airport Diner, Lakehouse Grille, Italian Farmhouse, Foster’s Boiler Room, Lago, Camp and Town Docks.

“Individuals right now are more frugal,” says Jason Lyon, chief executive of Common Man.

Under the theme of “We Feel Your Pain,” Common Man is conducting an “Uncommon Passport” promotion, which awards diners a $50 gift card after they visit five of the chain’s 16 locations, which include the Common Man Inn, The Spa at the Inn and the Common Man Co. Store.

“We look for a value-added discount,” Lyon says. “We believe the passport is a prime example of it.”

Diners have to make a $20 purchase to have their passports signed by the restaurant manager, he says, but when two people dine together they’ll spend more than that.

The promotion, which began in late March and runs through May 22, has been a “tremendous success,” Lyon says, and “in the long run, we’ll benefit from it.”

Common Man’s diner concepts are featuring a Monday kids-eat-free program; “Toss Up Tuesdays,” which allow customers to flip a coin for half off their entrées; all-you-can-eat spaghetti nights on Wednesdays; and “Thrifty Thursdays,” when college students with valid identification are offered a buy-one-getone-free entrée deal.

Lakehouse Grille offers a $19.95 three-course meal on Tuesdays, and Italian Farmhouse conducts a family promotion on Wednesday nights. Families of two or more can order a three-course meal for $5.99 a person.

Price levels are set based on “gut instinct combined with how much you want to wow your guests,” Lyon says.

Brainstorming sessions also determine the type of promotion and how to price it, which is how the Wednesday spaghetti night at the diners was developed. Wednesday traditionally has been spaghetti night for families in the United States, Lyon says, and Common Man wanted to “tap into the root of our culture” with a nostalgia-inducing promotion.

The chain has been “very aggressive” with its promotions, Lyon says, and sales are higher this year than they were a year ago at this time.

“We look at the downturn not as a time to withdraw or scale back,” he says. “We look to expand sales.”

Sales are up, too, at Salut Bar Americain, one of the restaurant concepts developed by Parasole Restaurant Holdings, based in Edina, Minn. The company’s chief executive, Phil Roberts, believes one of the reasons for the volume gain is that Salut has become a “very acceptable alternative” for diners who once frequented Morton’s or Ruth’s Chris steakhouses or other higher-end restaurants but now are deciding to spend $50 on a meal instead of $100.

As of April 24, sales at Salut were up 7.4 percent compared with the same time last year, and customer counts were 5.3 percent higher.

“We have not changed any menu items, we have not cut portions or price, but we added a category with smaller portions,” says Roberts, who describes Salut, Pittsburgh Blue Steakhouse, Figlio and the company’s other restaurants as occupying the “polished end” of the casual-dining segment.

Parasole has begun offering Sunday Suppers, priced at $8.95 per person with a two-person minimum, to get people into Pittsburgh Blue, whose Sunday Supper is pot roast; Salut, which features “super sliders”; and Figlio, which serves lasagna.

The Ashland, N.H.-based Common Man restaurant group is offering various “budget-friendly” promotions across its 13-unit system of concepts, including Airport Diner, targeting families and students.

About 30 percent of diners order the meals, Roberts says, and customer counts are up.

Salut also has “Le Deal,” which includes an appetizer, entrée and dessert, priced at $9.95 at lunch and $14.95 at dinner.

That offer makes Salut “ultimately approachable” and negates the veto factor, because the person in the party of four who doesn’t want to order a regular-priced item can order the deal, Roberts says.

He adamantly opposes price cuts at his restaurants and warns upscale restaurants to avoid them as well.

“It’s real easy [for reduced pricing] to look like a cry for help,” he says, “and it damages your brand.”

The threat of tarnishing a brand image is why CKE Restaurants Inc., based in Carpinteria, Calif., continues to promote premium products at its system’s 3,067 Hardee’s and Carl’s Jr. restaurants and avoid advertising lower-priced value items, says Brad Haley, executive vice president of marketing.

Neither burger chain has a value menu like those at quick-service competitors, but Hardee’s and Carl’s Jr. offer a few lower-priced menu items, he says, and they’re mostly promoted in-store, not on TV.

“We built our brands by focusing on premium-quality food, and the Six Dollar Burger at Carl’s and the Thickburger at Hardee’s are the best examples,” Haley says. “Just because the economy is softening, we’re not about to deviate from our positioning for short-term benefits.”

Because “there’s always a market for high-quality food at a fair price,” Carl’s Jr. and Hardee’s have an opportunity now to promote quality while its competitors are advertising meal discounts, he says.

Discounted meals are appealing to people who don’t have a lot to spend, Haley says, but if they do have the money, they’ll spend it on a higher-quality meal.

Pricing strategy in the quick-service category is “extremely important to brand equity,” says Dahlen of IAG Research.

Chains have to be willing to sacrifice margins during the promotion “if in fact it helps increase traffic and the top line,” he says.

When times are good, price incentives are not necessary to drive customer traffic. New-product news will do that, Dahlen says, but lean times demand more.

“From a marketing standpoint,” he says, “you have to do anything it takes.”