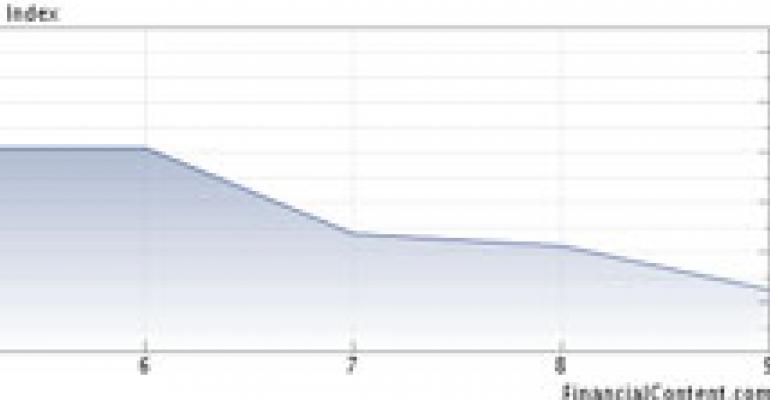

NEW YORK Restaurant stocks couldn’t maintain their December and New Year’s rally as more grim economic news, including a December unemployment rate of 7.2 percent, led to a sector downturn for the first week of 2009.

For the week ended Jan. 9, the Nation’s Restaurant News Stock Index fell 5.64 percent, a heavier weekly decline than the Dow Jones industrial index, which dropped 4.82 percent, and the S&P 500 index, which fell 4.45 percent. On Friday, the NRN index fell 1.78 percent to close at 964.64.

The market took its heaviest hits on Wednesday, driven by weak corporate news from financial, retail and auto companies, and on Friday, when the government reported the highest level of unemployment in 16 years. With more than 11 million Americans now unemployed, strong consumer spending is doubtful.

“Falling energy and commodity costs and a looming stimulus package will help the consumer in 2009,” restaurant securities analyst Jeff Farmer at Jefferies & Co. Inc. said in a note to clients last week, “but we remain in the camp that a rising unemployment rate, continued home price declines, meaningful stock market losses and a near-term focus on cleaning up personal balance sheets will continue to weigh on consumer spending in 2009.”

December’s unemployment rate was the highest since January 1993, according to the U.S. Department of Labor report. The number of jobs fell by 524,000 over the month and by 1.9 million during the last four months of 2008. Since the start of the recession in December 2007, the number of unemployed persons has grown by 3.6 million, and the unemployment rate has risen by 2.3 percentage points, the report revealed.

The U.S. unemployment rate and its effect on consumer spending have replaced concerns related to high gas prices among many operators. About two dozen public restaurant companies will be presenting this week at the Cowen and Co. Consumer Conference in New York, where, typically, corporate executives offer some of their first takes on the year ahead.

Last week, industry news was not positive, as casual-dining operator Ruby Tuesday Inc. posted widening losses and still-declining sales, and as quick-service franchisor Sonic Corp. posted a 47.5-percent drop in quarterly profit.

“We don’t expect much of a turnaround in fundamentals until at least the second half of 2009, when most companies begin to lap easier [same-store sales] and significant cost pressures,” said securities analyst John Glass at Morgan Stanley & Co. Inc.