With markets roiled once again Thursday over the coronavirus pandemic, public restaurant companies saw their share prices continue to slide.

At midday, the Dow 30 was down more than 9%, the Nasdaq down more than 8% and the S&P 500 — which triggered a technical halt in trading earlier Thursday, following another one Monday — was down more than 8%.

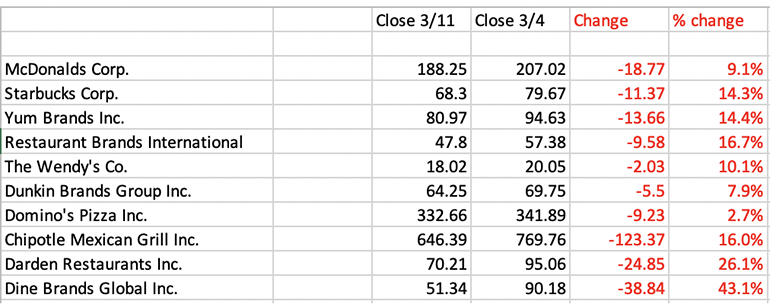

In comparing closing prices from Wed., March 4, to Wed., March 11, the biggest declines among the Top 10 publicly traded restaurant companies were those in the full-service and casual-dining sector.

Glendale, Calif.-based Dine Brands Global Inc., owner of the casual-dining Applebee’s Neighborhood Grill & Bar and family-dining IHOP brands, posted a 43.1% decline in market price, sliding from $90.18 on March 4 to $51.34 on March 11.

Orlando, Fla.-based Darden Restaurants Inc., owner of the casual-dining Olive Garden and LongHorn Steakhouse brands among others, saw its stock price decline 26.1% in that week period, which was marked by escalating news of more coronavirus, or COVID-19, cases in the United States and even larger outbreaks abroad.

Amid the coronavirus stock carnage, investors showed relative faith in brands like Dunkin Brands Group Inc. and Domino’s Pizza Inc., a player that has long had its own in-house delivery system in place.

Dunkin’s stock price only slipped 7.9% in the weeklong period, and Domino’s Pizza was relatively unscathed with a 2.7% decline.

John Gordon, principal at San Diego, Calif.-based Pacific Management Consulting Group, noted that about 65% of stock trades are run by computer algorithms or programs.

“What I see here is some human intervention on restaurant trades so that that brands without drive-thrus [Dine Brands and Darden] must have a longer in-house interaction and might be thus perceived by guests as ‘more risky,’” Gordon said in an email. “This despite the fact that DRI management and trends are stellar, as you know.

Gordon said the pizza and coffee segments represent "faster and on the go” transactions. He also noted that Dunkin does not have the larger scale exposure to the China market, where the coronavirus was first diagnosed in Wuhan, that Starbucks has with its China stores.

“The other QSR majors clumped around -10 to -14 make sense given the overall skew to date,” Gordon added. “Given the pull back of meetings and commercial/social activity, we will be down for a while, unfortunately.”

Other analysts are echoing that sentiment. “With markets now beginning to price in the palpable anxiety of a looming recession, dislocations for some equities are approaching the limits of, and in some cases have exceeded, what is reasonable,” Jefferies Equities Research said in a note earlier this week.

Also factoring into the stock sell-off was the decision by Saudi Arabia to lift production limits on crude oil in a battle for market share with Russia, which sent the price per barrel plummeting and put U.S. shale-oil producers are risk.

“While the currently unquantifiable impact from COVID-19 already had investors on edge,” Jefferies said, “the announcement of a full-blown crude price war has led to a dramatic risk-off shift.”

Contact Ron Ruggless at [email protected]

Follow him on Twitter: @RonRuggless