Kids may have little appetites, but they can be big business for restaurant operators. The trick is figuring out what the current generation of pint-sized diners—and the grownups who order for them—want.

According to new data from The NPD Group, today’s kids are less interested in the kids’ meals with toys or kids’ menus than they once were. Still, meals ordered by children accounted for 1.3 billion visits to restaurants and $5.6 billion in sales in 2008, signaling a huge opportunity for restaurant operators, say officials at the Port Washington, N.Y.-based market research firm.

“They influence where the family goes, and you have to have things to appeal to them,” said NPD analyst Bonnie Riggs. “I don’t know that kids’ meals are where it’s at [with today’s kids, however].”

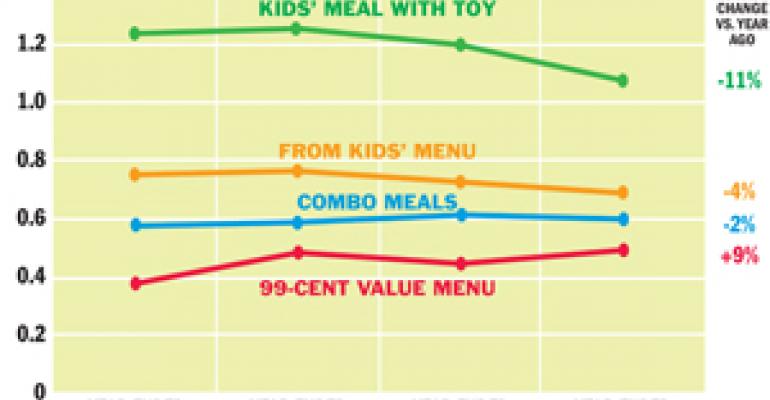

Even though kids’ meals with toys and kids’ menus continue to be the most popular options for children younger than 13, both have seen sharp declines in recent years, NPD found. Instead, more diners younger than 13 order off the $1 value menu. That figure is up 9 percent, according to NPD.

At quick-service outlets the food kids order most often is pizza, according to NPD. Kid staples like French fries and chicken nuggets are still popular, but have begun to fall out of favor, the data found. Items gaining in popularity include hamburgers, tacos and pasta. For younger kids, fruit and ice cream make up a small percentage of orders, but are gaining in popularity.

While kids prefer pizza at quick-service outlets, pasta rules at full-service restaurants, NPD found. In addition, NPD found that pasta is gaining in popularity among 6-to-12-year-olds. This is related to kids’ passion for macaroni and cheese, which is served at nearly 12 percent of full-service visits by kids younger than 6 and 9 percent of full-service visits by those 6 to 12 years old.

Regular carbonated soft drinks are still No. 1 with kids, but the popularity of pop is dipping. Meanwhile, milk is on the rise with young kids at both quick-service and full-service restaurants.

One reason for the decline in the number of kids’ meals with toys and kids’ menu items ordered is that fewer kids are eating out, NPD discovered. Traffic for parties with kids declined 3 percent last year, after being positive for more than three years prior. In contrast, traffic for adult-only parties was positive last year and for several years prior.

In 2008 both quick-service and full-service restaurants experienced traffic losses—4 percent and 3 percent, respectively—in diners younger than 13. Ninety-three percent of traffic losses from those younger than 13 at quick-service restaurants came from children younger than 6 and just 7 percent came from children 6 to 12 years old. During the same period, 64 percent of traffic losses at full-service restaurants came from children younger than 6 and 36 percent from children 6 to 12 years old.

The losses are occurring at all dayparts, but dinner is being hit the hardest, NPD found. Forty-seven percent of quick-service traffic lost from children under 6 and 81 percent lost from children 6 to 12 occurred at dinner. At full-service restaurants, 49 percent of traffic lost from children under 6 and 55 percent lost from children 6 to 12 occurred at the evening meal.

“That’s a big impact on supper,” Riggs said. “Part of it is we’re not going out to supper either, but when we do, we’re not taking [the kids] out.”

The decline in the number of parties with kids is due in part to the ailing economy, NPD found. That’s not surprising, Riggs said, given that in 2008 the average check size for adult-only parties was $9.70, and for parties with kids it was $17.38. A desire to save money may also be driving consumers who do bring the kids to order from value menus, Riggs noted.

But the shift away from kids’ meals and menus began well before the economy slumped, so there’s more to this than money, Riggs said, noting that the shift may be related to young diners’ desire for more choices or more sophisticated fare.

“When we start taking kids to restaurants again, I think that trend in kids’ meals will continue,” Riggs said. “[When the economy recovers] they are going to come back into the market, but what are [operators] going to do to appeal to kids?”

Though the quick-service segment practically invented the kids’ meal, it’s family and fast-casual restaurants that seem to be trying to reinvigorate the meal type most these days. Many such operators aren’t waiting for the economy to recover, but instead are trying to attract more kids’ business with recently retooled menus that are heavy on choice.

Last year Wilbraham, Mass.-based Friendly’s rolled out a new kids’ menu for the first time in several years, adding a host of new entrées and sides and plating them in whimsical ways.

When asked if today’s kids want to order more grown-up fare, Skip Weldon, vice president of marketing for Friendly’s, said: “When it comes to their food, we haven’t found that kids want to be older. Kids want to feel like the items they choose, the brands they choose, [are] for them.”

To empower kids and keep them coming back, the family-dining chain created an adventure-theme kids’ menu that allows diners 12 and younger to choose a drink, entrée, side and dessert from a variety of options to create their own customized meal priced at $3.29, $4.49 or $6.49. Among the best-selling items are Dippin’ Chicken, fried-chicken strips served in a cone-shaped wire vessel with three dipping sauces, and Cheeseburger Sliders, two or three mini burgers topped with cheese. The chain also launched

The efforts are paying off so far, Weldon said, noting that the changes have helped Friendly’s significantly grow kids’ business in the last year.

Parents with kids dining at Denver-based Chipotle no longer have to struggle to find suitable kids’ fare from the fast-casual chain’s main menu, which features portions that can be generous even for some adults. In early April, Chipotle began testing a new kids’ menu in its 60 Denver stores.

“When Chipotle started we didn’t think of it as a kid-friendly restaurant,” said spokesman Chris Arnold. “What we’ve seen over the years is…people choosing quesadillas and tacos [for kids]… We took a cue from our customers.”

The new menu features child-friendly items, such as quesadillas, single tacos and a build-your-own taco kit, all priced at less than $4, including juice, organic milk or a small soda.

To spread the word, Arnold said Chipotle is doing a series of “Kids eat free on Sundays” promotions at Denver locations.

Beaverton, Ore.-based Shari’s Restaurants is betting that more healthful fare will appeal to kids, or at least to their parents.

Though its kids’ menu long has featured healthful sides that kids can choose to add on to favorite entrées, such as grilled cheese sandwiches and mini burgers, in February the chain swapped out a brownie-type cookie-on-a-stick for GoGurt, yogurt in a tube from Yoplait, as the kids’ menu giveaway.

Shari’s vice president of marketing David Archer said it’s too soon to measure the impact of the product on traffic.

Though many operators are making serious efforts to appeal to kids, the majority still are doing the same thing as their competitors, said Linda Duke, a cookbook author and owner of San Rafael, Calif.-based Duke Marketing. “There’s a huge opportunity with unique and creative menu offerings.”

But innovative offerings alone aren’t enough. Restaurants have to find effective ways to promote those items, Duke says. To drive kids’ traffic Duke suggests restaurants offer kitchen tours, cooking classes or hand out samples to peewee sports teams.

Nation’s Restaurant News has an exclusive agreement to obtain the NPD Group data and research findings that appear on the Consumer Trends page.