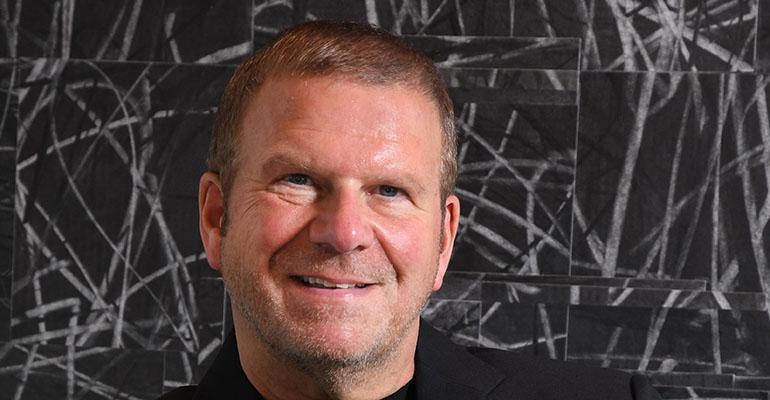

Texas billionaire Tilman Fertitta is reportedly in talks to take his restaurant giant Landry’s Inc. and his Golden Nugget casino holdings public with Fast Acquisition Corp., though the special purpose acquisition had been looking for quick-service brands.

Bloomberg, in a report last week citing “people with knowledge of the matter,” said Fast Acquisition, which was created last August as a special purpose acquisition company, or SPAC, was considering raising more than $1 billion to back a possible transaction.

Fertitta’s representatives said he would have no comment on the rumors.

Fast Acquisition Corp. was listed on the New York Stock Exchange last August and set a target to raise $200 million. It was created by Doug Jacob, co-founder of &Pizza and co-CEO of the new blank-check SPAC, with Sandy Beall, the founder of the Ruby Tuesday brand.

“We’re looking for quick-serve, fast-food, small-dining-room brands that we can take from good to great — so brands that have actually done OK during COVID,” said Jacob in an interview when Fast Acquisition was listed.

Kimberly Grant, Sandy Beall, Doug Jacob, Garrett Schreiber and Stacey Cunningham, NYSE president.

Fertitta had been mulling various financing options, Bloomberg reported. Houston-based Landry’s owns such brands as Del Frisco’s, Mastro’s, Morton’s The Steakhouse, McCormick & Schmick’s and Bubba Gump Shrimp Co.

Fertitta has his own acquisition companies under the Landcadia Holdings umbrella.

Landcadia Holdings II Inc., sponsored by Fertitta Entertainment Inc. and Jefferies Financial Group Inc., in December merged with Fertitta’s Golden Nugget Online Gaming Inc., an online gaming and digital sports entertainment company.

Landcadia Holdings Inc. in 2018 merged with online ordering and delivery platform Waitr Holdings Inc. in a $308 million deal. Landcadia Holdings III Inc. raised $500 million last year to pursue an acquisition or merger.

Landry’s was public from 1993 to 2010, when Fertitta took it private in a 2010 $1.4 billion leveraged buyout. He bought the Houston Rockets in 2017 for $2.2 billion.

Landry’s Inc. owns and operates more than 600 properties in 36 states, including such additional brands as Chart House, Claim Jumper, Joe’s Crab Shack, Landry’s Seafood House, Mitchell’s Fish Market, The Oceanaire, Rainforest Café and Saltgrass Steak House.

Update Jan. 20, 2021: This story has been updated with information from Tilman Fertitta's representatives.

Contact Ron Ruggless at [email protected]

Follow him on Twitter: @RonRuggless