This post is part of the On the Margin blog.

This post is part of the On the Margin blog.

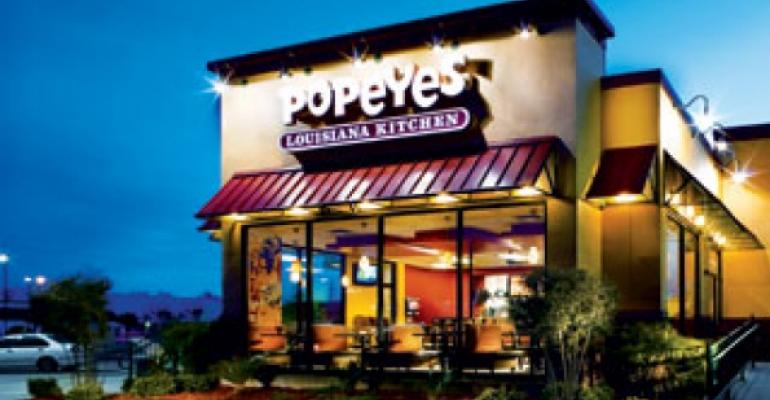

Is Restaurant Brands International Inc. interested in Popeyes Louisiana Kitchen Inc.? Depends on who is doing the reporting, apparently.

On Monday, Reuters reported that the owner of Burger King and Tim Hortons has approached the chicken chain in a potential bid for the company. The stock responded accordingly, skyrocketing 14 percent.

Not so fast, according to the New York Post, which reported that RBI was interested in buying Popeyes “a few months ago,” but has since backed off.

The stock, perhaps unsurprisingly, is down 7 percent Tuesday morning.

The reports confirm chatter that RBI had, at least at one time, genuine interest in acquiring Atlanta-based Popeyes as its third brand. They also signal that RBI is on the lookout for another concept.

RBI more or less signaled interest in further expansion the moment it opted for “QSR” as its ticker symbol, after naming itself “Restaurant Brands International” following Burger King’s 2014 acquisition of Tim Hortons.

The Reuters report, in fact, suggested that RBI is looking at other brands to potentially acquire.

Any number of companies could potentially fit the RBI brand acquisition playbook, should it indeed decide to take on a third concept. Remember: The Tim Hortons deal was massive, and so Restaurant Brands International could take on a mighty large company.

The company could buy anything from Subway to Dunkin’ Brands Group Inc., or even a private company such as Arby’s. Some have even gone so far as to suggest it could gobble up Yum! Brands Inc.

Yet few would make as much sense as Popeyes, which operates more than 2,600 global locations and has taken itself from a struggling regional concept into a growing national chain, after several years of consistent performance.

3G Capital acquired Burger King in 2010, and then engineered the Tim Hortons deal based largely on the theory of the brands’ long-term unit growth potential. Both brands had tremendous white space in international markets and operated concepts with menus proven on multiple continents — Burger King, with burgers, and Tim Hortons, with coffee. And both brands were primarily franchised.

Popeyes is a nearly fully franchised concept. Chicken is a proven menu concept, thanks to the strong global performance of Yum-owned KFC. It also has all sorts of unit-growth potential.

That growth could come in the U.S., where Popeyes has half the unit count of KFC. But most of it would come outside the U.S., where the company only has about 600 locations. Under 3G, the company could quickly accelerate growth.

It remains to be seen whether RBI is interested in Popeyes or not. But a deal makes sense from here.

Jonathan Maze, Nation’s Restaurant News senior financial editor, does not directly own stock or interest in a restaurant company.

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @jonathanmaze