Taking into consideration the impact of Superstorm Sandy on the East Coast, restaurant industry same-store sales performed reasonably well in November, according to the latest NRN-MillerPulse survey, though operators are not optimistic looking to 2013.

MillerPulse, an operator survey exclusive to Nation’s Restaurant News, questioned operators from 44 restaurants in December regarding November sales, profit trends, performance and outlook. Respondents included operators from all regions of the country that represent the quick-service, casual-dining, fine-dining and fast-casual segments. Those surveyed in December represented restaurants that booked about 16 percent of industry sales.

RELATED

• Restaurant operators expect November sales to hold steady

• Restaurant same-store sales soften in September

• More restaurant industry finance news

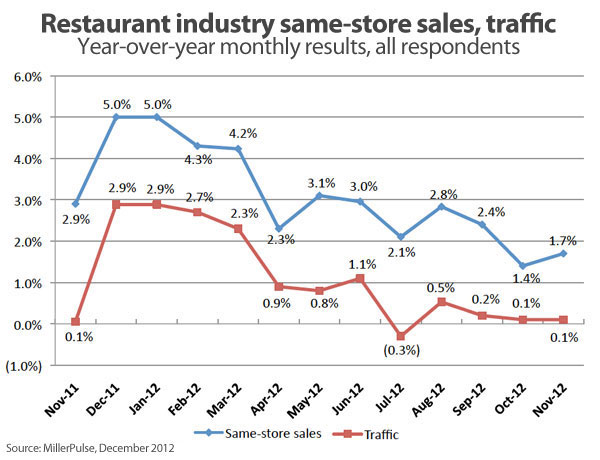

Industry same-store sales rose 1.7 percent in November, the survey found. While that number is less than the 2.1-percent increase in October, the performance was solid, taking into account the impact of Superstorm Sandy. The storm struck the East Coast at the end of the October and resulted in flat sales for the first two weeks in November, said Larry Miller, restaurant securities analyst at RBC Capital Markets and creator of the monthly MillerPulse surveys.

“This was a nice bounce back in sales,” Miller said. “The whole market got better. You take out casual dining and the weather, and it looks pretty good.”

Miller referred to the casual-dining segment’s continued struggle to find it’s footing. Same-store sales for the segment fell 1.1 percent in November and traffic dropped 0.9 percent, the survey found. However, the full-service segment as a whole, which includes both fine-dining and casual-dining brands, saw a 0.5-percent increase in same-store sales in November after a 0.3-percent decline in October.

“Consumers are not finding the value at casual-dining restaurants,” Miller said. “And you can see they are increasing their promotions.”

Quick-service restaurants, which include both fast-food and fast-casual brands, continued to perform strongly, driven by a 0.3-percent increase in traffic at fast-food restaurants, the survey found. Same-store sales rose 2.9 percent at quick-service restaurants in November, up from a 2.8-percent increase in October.

Despite a stable November, restaurant operators are nervous looking ahead to 2013. While a majority of the operators surveyed expect sales to be better in December than they were in November and casual-dining operators believe things will pick up during the holidays, the outlook for the next six months was negative across all segments except for fast-food, fueled by concern over the economy, weather and commodity inflation. And Miller shares their worries.

“I see a lot of fear in that outlook,” Miller said. “If we go over the fiscal cliff, everyone will see higher taxes. I’m not that optimistic. 2013 looks like a tough year.”

Register for MillerPulse at millerpulse.com

Contact Charlie Duerr at [email protected].