Chipotle’s first store opened in 1993. Several brands were tinkering with something like fast casual throughout the 1990s. The segment formalized just before 2000 when industry groups specializing in fast casual came on the scene, and industry analysts started tracking them.

That was over 20 years ago.

No substantial innovation to the restaurant business model has occurred since. To say that the digitization of the industry, and the incorporation of delivery, are business model innovations is incorrect. These two things have happened, and restaurants have innovated to incorporate them into their existing business models, but no new segment has arrived — until now.

To qualify as a segment, a restaurant business model must be different from other segments on three dimensions:

How it brings value to guests

How it engages with guests

How it allocates its P&L to create value for guests and make money for itself

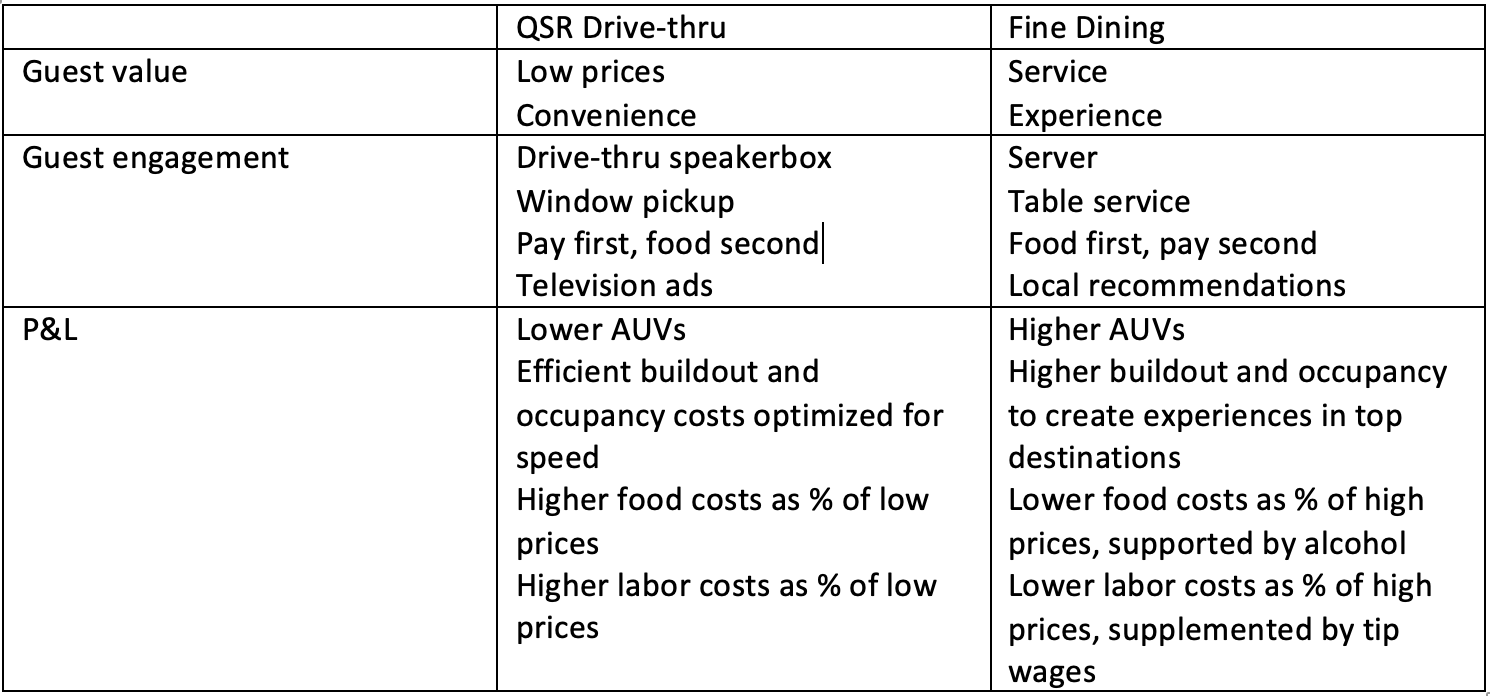

For example, in all three dimensions, QSR drive-thrus are very different from fine dining.

Even consumers who don’t work in the industry can look at these two segments and see their differences. Different guests use them on different occasions for different purposes. Meanwhile, a QSR drive-thru with a second lane for mobile order-ahead is mostly the same as a QSR drive-thru with one lane. Likewise, a fine-dining restaurant with shelves behind the host stand for delivery and takeout is mostly the same as a fine-dining restaurant without shelves.

As consumers, we'd say these restaurants have added ways for us to order and fulfill, but they have not fundamentally changed the value to the guest or the P&L of the restaurant. Other segment ideas — like fast fine or fine casual — are minor revisions to existing business models. Fast fine is fast casual, with possibly higher prices for nicer food or a better ambiance, but nothing else has changed.

Fine casual is casual dining, similarly with higher prices to pay for nicer food or a slightly better ambiance. Again, these concepts are not fundamentally new business models; they don't differentiate on all three dimensions: guest value, engagement, and P&L.

Have we done it all, then? Is fast casual all there is? No further innovations beyond this pinnacle of restaurant success? Certainly, fast casual is alive and well. A third of the fastest-growing brands in 2022 were fast casuals, according to Technomic. But to stop at fast casual would be absurd. The consumer continues to evolve, technology continues to evolve, and our environment — commodity prices, real estate prices, labor prices — continues to evolve.

We believe the next big restaurant category is approaching, combining ghost kitchens, virtual brands, digital engagement, delivery fulfillment, electric cooking, intelligent software automation, and hardware robotics. Toiling away in 2023, much like Chipotle was back in 1993, are dozens, perhaps hundreds, of restaurants we call "Digitally Native Restaurants." When this segment is fully developed, like QSRs, the Digitally Native Restaurant will spread widely and quickly.

A superior guest offering with superior business model economics grows. Imagine a restaurant that so optimized its footprint, labor, and delivery labor that it could have 40% food costs — on purpose! What if this restaurant that gave $4 of food to the consumer for just $10 via delivery and made money doing it? With a low, upfront investment in a small delco unit, what if this restaurant generated fantastic returns? This type of restaurant would be everywhere.

The Digitally Native Restaurant is different from the segments that exist today on all three dimensions — guest value, guest engagement, and P&L. With its lower occupancy costs through ghost kitchen locations and its lower labor costs through intelligent software automation and hardware robotics, the Digitally Native Restaurant can re-orient its P&L to invest in what consumers do care about (food quality, delivered convenience) rather than what they don't care about (payroll and taxes, an unmemorable front-of-house), and do it all for a price that gives the guest exceptional value. With its intelligent software automation, the Digitally Native Restaurant can engage with guests and workers in ways that even today's most advanced apps and software are just giving us a hint of.

To get there, innovative restaurateurs have to start from first principles aimed at the new consumer demand. For example, asking, "If consumers want delivered food, what is the best way to get it to them?" from a blank sheet of paper will lead to different answers than the question, “how can my restaurant add delivery as a line of business?” These different answers in business model and guest engagement will lead to better accuracy of orders, and faster deliveries that consistently show up in the window promised. This experience will drive higher volumes, enabling more deliveries and logistical efficiencies — especially if the resulting restaurant is able to offer this consistently executed experience at a great value.

Treating delivery as an incremental channel on top of on-premises orders is a fine choice. For many restaurants, it is the right choice. They have an existing kitchen. They want to drive as much revenue through that kitchen as possible. But the Digitally Native Restaurant model will be higher-growth than traditional restaurants whose delivery channel is secondary to the core on-premises business.

Don't believe it is happening? Look at the number of existing restaurants throttling or charging exorbitant prices through marketplace channels. Restaurant executives are demonstrating through their actions that they are deprioritizing the customers that use those channels. As Digitally Native Restaurants serve the demand for delivery efficiently and effectively, they will become the high-growth concept of the restaurant industry.

What delivery-optimized Digitally Native Restaurants will do is be the go-to for delivered food. As we shared in our first book, Delivering the Digital Restaurant—Your Roadmap to the Future of Food, the entire pizza cuisine category optimizes for delivery in everything it does — its location, buildout, packaging, and consumer interface. Delivery-centric Digitally Native Restaurants will do the same. Pizza has this channel figured out. The next wave of growth in the restaurant industry will apply the lessons of pizza to other cuisine types.

All other cuisine types need look no further than pizza's evolution to understand what’s to come. Pizza started out through dine-in. Anyone over 40 remembers going with their family to a dine-in pizza restaurant that probably had a salad bar, a jukebox, a pinball machine, and a tabletop Ms. Pacman. These types of pizza restaurants are now almost impossible to find. Instead, pizza restaurants have evolved to optimize for delivery; off-premises delco (delivery/carryout) units are small, cheap, and off the main drag. Delco units are near the households and businesses that order from them but are not in prime real estate. No one eats inside of them. Pizza is still on the menu at some dine-in locations, but it is not the primary way most of us eat pizza.

To become as deliverable as pizza is, other cuisine types must go through the same transition pizza has. The industry will split into purpose-built locations — some for dine-in and some for off-premises — just as pizza did. Those who try to do both must manage the complexity that comes with it. Today's guests are already telling the industry that delivered food is below their accuracy, speed, and quality expectations. The best-delivered food will come from the delco model of the future: a ghost kitchen, a large commercial kitchen, or a small, out-of-the-way unit.

To become as deliverable as pizza is, Digitally Native Restaurants will create digital engagement that is easier for the consumer and the restaurant. Today's frankensteined tech stacks that pass some data, but not all, and which are not interoperable, must go away. The source of the order and its path to the guest must become invisible to the cook, the expo, the server/driver. The orchestration of the many steps of cooking, assembling, and fulfilling an order must become more tightly interwoven. Without strong operations and multiple technologies to manage complexity, the customer experience will likely be inferior to those that simply eliminate complexity through focus on integrated technology.

To become as deliverable as pizza is, Digitally Native Restaurants must be masters of digital marketing with brands that resonate and differentiate. They will need to compete with the existing established brands and their vast pocketbooks of marketing dollars. To do this, they will use digital tools that optimize guest acquisition and especially repeat — taking advantage of the quality of food and experience for the low price. With their vast data repositories due to 100% digital engagement, Digitally Native Restaurants will be able to out-market traditional restaurant advertisers.

To become as deliverable as pizza is, Digitally Native Restaurants must be integrated with logistics in a way that the current delivery ecosystem makes difficult and expensive. Note that the pizza giants, even those that use third-party delivery partners for overflow at peak, mostly maintain their own fleets of drivers and are innovating vehicles for new forms of last-mile logistics.

Most of the experimentation in this segment is currently driven by independents. Chili’s was working on a delivery-only location, but has shut it down. RBI recently closed Kylo, their version. Wendy’s is refocusing on its core prototype, dramatically reducing its growth plan with Reef. Chick-fil-A still has its Little Blue Menu ghost kitchen, and has expanded access through its app, although not yet locations. Inspire continues to operate Alliance Kitchens, but has not announced any additional locations. As generally happens in innovation, those with an existing, profitable business model are rarely the ones to figure out how a new business model will work. It speaks to the dramatic shift in consumer behavior, and the challenges of the current delivery ecosystem, that these large companies have even tried.

We expect that entrepreneurs with the vision, the willingness to start with first principles, the courage to try alternative logistics solutions, and most of all, the access to integrated technology that ties these things together to make everything 'work.' This new category has already arrived — maybe through the side door without much fanfare or attention — but it's here and will be the next big thing for our industry.

AUTHOR BIO

Meredith Sandland and Carl Orsbourn are co-authors of “Delivering the Digital Restaurant: Your Roadmap to the Future of Food” and “Delivering the Digital Restaurant: The Path to Digital Maturity.” After each spent 20-plus years in corporate strategy and retail food, Meredith and Carl each concluded that food in America was changing. They left their corporate jobs in search of innovation that would transform the restaurant industry. Ghost kitchens, virtual brands, digital marketing, the gig economy and lean operations are at the heart of the future they envision. Carl is the COO of Juicer, a restaurant dynamic pricing company. Meredith is the CEO of Empower Delivery, software that powers delivery-centric kitchens. Subscribe to their newsletter and podcast at deliveringthedigitalrestaurant.com.