As if rising commodity costs and increased competition were not posing enough worries for big quick-service chains, their costly expenditures for television advertising now may be yielding a dwindling response from fast-food customers.

Major quick-service brands’ TV spots are getting lower grades from consumers this year compared with the previous year in such critical areas as being understandable and motivating product purchases, among other deficiencies, according to a new study of the ads’ creative and informational content.

The QSR Advertising Attribute Ratings Report 2007, by Sandelman & Associates, a national research firm that specializes in restaurant traffic trends, concluded that consumers are paying less attention to the TV spots and not liking very much what they do see.

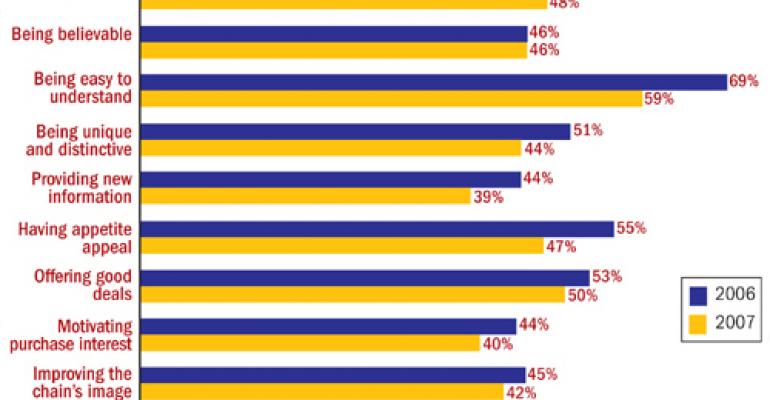

Overall, ad ratings for the first half of 2007 declined compared with last year for all but one of the 10 attributes assessed for broadcast spots by 24 chains, including Panera Bread, McDonald’s, Burger King, Wendy’s, Papa John’s Pizza, Pizza Hut, Taco Bell, Arby’s and KFC.

The ratings suggest that restaurant chains must come up with better, more persuasive creative content to engage consumers’ attention, said Bob Sandelman, chief executive of the San Clemente, Calif.-based firm.

“This may be telling us that consumers are seeing a lot of sameness, not a lot of a difference between one chain’s ads and another’s,” he said. “The lesson is you need to break out of the pack and come up with new and different ways to promote products.”

Of the 10 attributes measured, sharp dips in consumers’ rating were gauged for the TV commercials’ qualities of being unique and distinctive, understandable, and containing new information.

The one attribute that did not slide was believability, with 46 percent of the consumers surveyed rating the TV spots as very good or excellent in that area, unchanged from last year.

24 major chains’ TV spot ratings generally lower in 2007 SOURCE: SANDELMAN & ASSOCIATES. NATIONAL SAMPLE, JAN.-JUNE 2007

One of the most surprising results was the large decline in the rating for the ads based on being easy to understand, Sandelman said. Last year, 69 percent said the chains’ broadcast spots were either very good or excellent at being easy to understand, but only 59 percent said the same thing this year.

Although there is “really no way to know for sure” why consumers feel that way, Sandelman said, it could be that chains are trying to cram too much information into shorter commercials.

Fewer consumers gave high marks to the ads’ ability to provide new information about the chain, with 39 percent rating the ads as very good or excellent in that regard, versus 44 percent last year.

Almost the same number of consumers this year as last year rated the ads as very good or excellent in being likeable: 48 percent this year, compared with 49 percent in 2006.

Among the brands that ranked high for likeable ads were Panera Bread, Jack in the Box and Subway. Sixty-one percent of consumers said Panera’s TV ads were very good or excellent in likeability, while 57 percent said the same thing about ads by Jack in the Box, and 56 percent gave that high rating for Subway’s TV commercials.

Yet the ratings fell by 7 percentage points this year when consumers ranked all the chains’ TV ads for “being unique and distinctive”—indicating that fast-food customers may believe that the quality of the ads is not at the same level as the TV shows they appear in, Sandelman said.

“In the recent past the quality of programs, especially on cable—maybe not on the networks—has increased quite a bit,” he said, citing “Damages” on FX and “The Closer” on TNT.

When consumers compare QSR ads to concurrent programming, they might feel that “the advertising doesn’t measure up,” he said.

Among consumers in the survey, 58.5 percent said ads for Jack in the Box were very good or excellent in being unique and distinctive, while 58.2 percent rated Chick-fil-A’s ads the same way and 55.4 percent said ads for Rally’s Hamburgers were very good or excellent in terms of distinctiveness.

If consumers perceive TV spots as being alike, less easy to understand and not delivering new information, it’s not surprising that their ability to motivate purchase interest declined, Sandelman said.

This year, 40 percent of consumers said the ads did a very good or excellent job at motivating purchase interest, compared with 44 percent last year.

The lower ad ratings this year could be a result of consumers paying less attention to TV ads in general and fast-forwarding past them when they watch shows on their digital video recorders, Sandelman said.

Whatever the reason may be for growing consumer apathy toward quick-service chains’ TV ads, blame shouldn’t be placed on the products being sold, Sandelman said, but on “the way they’re advertised.”