Experts predicted a dismal 2008 for the entire foodservice industry, but it appears the chains that were able to lure spending-wary consumers with value-oriented deals weathered the storm better than their counterparts who pursued by-the-book pricing policies.

In addition, while many concepts succumbed to the increasing economic pressures, suffering losses, shuttering units or closing altogether, new data from market research firm The NPD Group shows the restaurant industry in general held its own throughout much of 2008.

For the 12 months ended in September, industry traffic rose about 0.5 percent on top of a 1-percent increase a year ago, according to Port Washington, N.Y.-based NPD. Consumer spending was up about 2 percent on top of a 3-percent hike for the previous year.

“It’s not a real positive picture, but [the industry was] able to hold its head above water,” said Bonnie Riggs, an NPD analyst. “There are concepts and chains not doing well, but the industry as a whole felt pretty stable.”

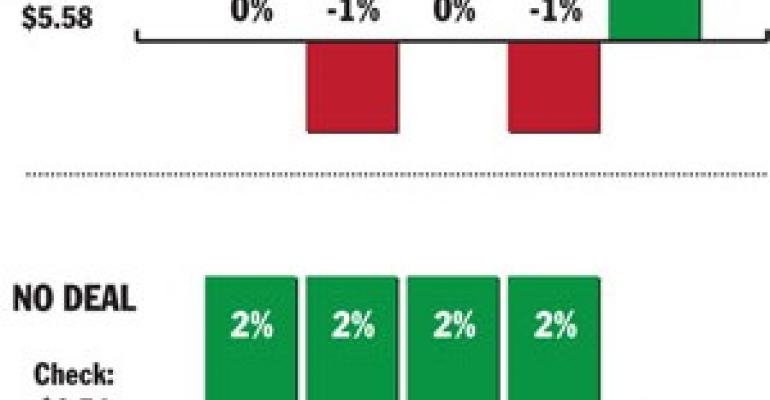

Deal-related traffic was what kept the industry from experiencing a negative trend in traffic, NPD found. In the year ended in September, deal traffic was up 4 percent on top of negative 1 percent a year ago. For the first time in five years, the industry saw a downturn in nondeal traffic. For the 12 months ended in September, nondeal traffic was down 1 percent.

“We haven’t seen any increase in deals in a number of years,” Riggs said. “That’s what operators have to do to survive at this time.”

The meager traffic growth can be traced largely to restaurants’ heaviest users—young people and families with children—who cut back on restaurant visits most this year. In the year ended September, consumers aged 18 to 24 made 21 fewer meal and snack visits than in the previous year. Those under 18 made six fewer meal and snack visits. In contrast, older adults were responsible for supporting industry traffic. During the same period, adults 35- to 49-years old made three more visits, and those 50- to 64-years-old made six more visits.

The slight increase in consumer spending was supported almost entirely by a lift in check size, which was modest considering the rise in food inflation, Riggs said. In the 12 months ended in September, the average check was $6.32, up from $6.21 a year ago.

Among the many factors plaguing the foodservice industry in 2008 were rising food and energy costs, the continued housing crisis, the credit crunch, the plummeting stock market and deteriorating consumer confidence. On top of those issues, disposable personal income growth grew less than 1 percent, unemployment shot up to nearly 6 percent and inflation topped 5 percent, the highest since 1990.

“The situation got particularly bad during the summer months when demand is typically at its highest for the restaurant industry,” Riggs said.

While traffic at quick-service restaurants slowed in 2008, it nevertheless was the segment that fared best. In the year ended in September, quick-service traffic was up 1 percent on top of a 2-percent increase in the prior year. All other segments reported flat or negative traffic counts. It was deal-related traffic that kept quick-service restaurants in a positive position, Riggs said.

Major chains were best able to drive traffic in 2008, while small chains and independents struggled. In the year ended in September, traffic was up 2 percent at major chains but fell 1 percent at small chains and 2 percent at independent operators. The growth at major chains matched unit expansion and can be attributed largely to value promotions that resonated strongly with consumers, said Riggs.

“This is what happens at difficult times,” Riggs said. “The little guys just get hit hard.”

Snack, sandwich and retail concepts led the industry in traffic gains through widely used promotions, NPD found.

For the second year in a row, gourmet coffee and tea outlets topped the list of best-performing categories. For the year ended in September, there were approximately 219 million more visits to gourmet coffee and tea outlets, a 9-percent increase over the previous year.

Sandwich shops, a category that includes such major chains as Subway, Blimpie and Quiznos, enjoyed 166 million more visits, a 5-percent increase over the previous year.

Retail outlets had 130 million more visits, a 2-percent increase over the previous year.

With more than a 22-percent share of the industry traffic, hamburger outlets also were big winners. Burger outlets tallied 107 million more visits, a 1-percent increase over the previous year.

As was the case in 2007, traffic declines were most pronounced among categories heavily dependent on dinner. The varied menu, pizza, family-style and chicken categories suffered the steepest traffic losses this year.

The best-faring dayparts were breakfast and snack occasions. Both grew in 2008, although not as strongly as in recent years. After no growth in 2007, lunch saw a slight lift, likely due to many deals targeted at that daypart. Dinner continued to trend down after experiencing no growth since 2006.

The top-performing foods and beverages in 2008 were those tied to the best-performing dayparts and those that provided a consumer perceived deal, Riggs said. Iced tea, specialty coffee, burgers and breakfast wraps/burritos, topped the list of items with the biggest incremental servings increase over the previous year. In the year ended September, there were 352 million more servings of iced tea, a 7-percent increase over the previous year, and 351 million more servings of specialty coffee, a 14-percent increase. There were 233 more servings of burgers, a 3-percent increase over the previous year, while servings of breakfast wraps/burritos held steady at about 176 million servings.

Among the food and beverages with the steepest declines in incremental servings were regular carbonated soft drinks, French fries and chicken strips, NPD found.

While 2008 saw many casualties—coffee giant Starbucks closed units and casual-dining brand Steak and Ale filed for bankruptcy—some restaurants had remarkable success.

Among the biggest success stories was Oakbrook, Ill-based McDonald’s. In October the chain skirted the slowdown that hobbled so many concepts, posting a 5.3-percent year-over-year rise in U.S. same-store sales for the month. The increase was an improvement on the No. 1 burger chain’s already positive same-store domestic sales the prior month.

“lt’s not just one single thing that accounts for McDonald’s current success,” said spokeswoman Heidi Barker. “Convenient locations, extended hours, clean and comfortable restaurants, more menu variety than ever, and quality food at an outstanding value are all components of why people are choosing McDonald’s.”

Another key to the burger giant’s success is staying true to the brand, said Danya Proud, also a McDonald’s spokeswoman.

“In these tough economic times companies tend to drift from their plans,” Proud said. “We have not drifted from our U.S. Plan to Win. We have been extremely focused.”

Milford, Conn.-based Subway also hit it big this year, posting record sales and traffic.

“People are just more aware of Subway than they’ve ever been,” said Tony Pace, senior vice president and chief marketing officer for Subway Franchisee Advertising Fund Trust. “Subway’s brand recognition has more than doubled in the last two years.”

Pace attributes the chain’s success to value-based promotions such as the popular $5 foot-long sandwich, first introduced in early 2008, as well as a host of other efforts rolled out over the last few years including increased marketing and media efforts.

“We tend to be most successful when we are true to what Subway is,” Pace added.

Although gasoline prices significantly eased up in November and early December, and many see hope in the new President-elect’s economic plans, some experts say consumers’ fear of a worsening economy may mean another year of challenges for the industry.

“[2008] was a roller coaster ride,” Riggs said. “There were pockets of weakness in the industry, but there were also pockets of positive [results].”

But as far as 2009 is concerned, she added, “Nobody has a crystal ball.”

Nation’s Restaurant News has an exclusive agreement to obtain the NPD Group data and research findings that appear on the Consumer Trends page.