With a growing number of consumers heeding nutritionists’ recommendations to eat not just three square meals but up to six mini-meals throughout the day, savvy operators are finding that there’s money to be made by adding snack foods and beverages to their menus.

According to new data from The NPD Group, a Port Washington, N.Y.-based global market research firm, consumer snacking has markedly increased in recent years and snack occasions as a result have become a profitable daypart, especially for quick-service operators.

“This is really a hot topic,” said NPD analyst Bonnie Riggs. “Snacking has been on the rise. It really grew in 2007.”

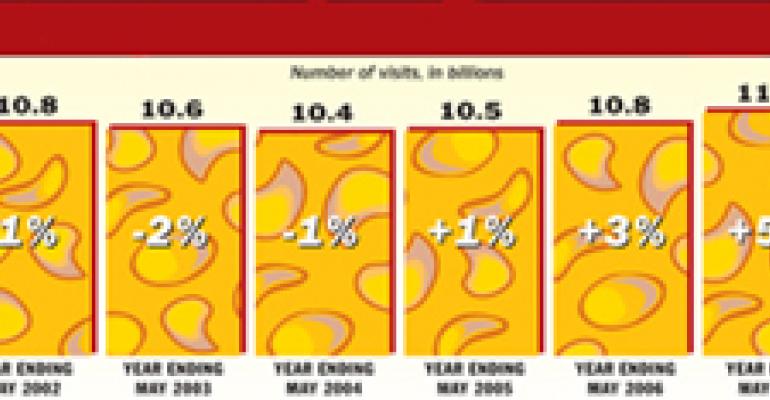

Snack occasions have been on the upswing for the past three years, and now account for 12.1 billion visits to the industry, according to NPD. The majority of those snack occasions occur at the quick-service segment, which accounted for 94 percent of all industry snacking occasions, or 11.4 billion visits in the year ended May 2007. NPD defines snack occasions as morning snack, afternoon snack or evening snack.

Outpacing lunch and supper gains, snack occasions have picked up share and now account for nearly a quarter of quick-service visits. From May 2005 to May 2007, snack traffic at quick-service restaurants increased 1 share point, or 867 million more visits. Lunch share held steady, while supper lost 2 share points, or 82 million fewer visits.

Snacks also are contributing to the overall traffic growth in quick service. In the year ended May 2007, snacking accounted for more than half of the segment’s traffic growth. Hamburger and gourmet coffee/tea outlets accounted for 25 percent of all snack occasions, NPD said.

“Sixty percent of QSR growth comes from snack-related occasions,” Riggs said. “That’s good news and bad news. It’s driving traffic at down times, but it’s a smaller check.”

For the year ended May 2007, the average check during a quick-service snack occasion was $3.24, compared with $3.86 for breakfast/brunch, $5.23 for lunch and $5.88 for supper.

“Operators have an opportunity to build that check, offering premium products with a higher price tag,” Riggs said. “Consumers are willing to pay for [that].”

Anytime can be snack time, but according to NPD, prime hours for snacking are at 10 a.m., between 2 p.m. and 4 p.m. and between 7 p.m. and 10 p.m. The afternoon snack is the most popular snack occasion, accounting for nearly half of all quick-service traffic growth in the year ended May 2007.

NPD said women are more inclined than men to snack at quick-service outlets, particularly in the afternoon. In the year ended May 2007, women accounted for 54 percent of all quick-service snacking and 56 percent of afternoon snacking. During the same period, 38 percent of afternoon snackers and 42 percent of evening snackers were young people under 25, and 30 percent of morning snackers were adults over 50.

Whatever their age or gender, consumers said that a convenient location was the top reason they visited quick-service restaurants for a snack in the year ended May 2007. Other top reasons were that they regularly frequent quick-service restaurants, had a special craving, liked going to quick-service restaurants or desired a specific menu item.

“There’s a lot of different reasons why snacking is growing as much as it is,” Riggs said. “Part of the reason…is a lack of time. We’re eating on the run or eating more often.”

When it comes to what they look for in a snack, time-pressed consumers said they seek foods that are portable, portioned and easily eaten on the go. Among the top snack items ordered in the year ended May 2007 were candy and candy bars, popcorn, beef jerky, nuts and peanuts, soft pretzels, granola or breakfast bars, frozen sweets, cakes, iced or frozen coffee, cookies, salty snacks, coffee, espresso, lattes, and smoothies.

Among the items to watch are iced and frozen coffee drinks, Riggs said. According to the data for the year ended May 2007, 56 percent of the time that iced or frozen coffee was consumed was as a snack.

“That number is going to go even higher now that [major quick-service chains] are introducing iced coffee,” Riggs said.

Oak Brook, Ill.-based McDonald’s Corp. is among the chains looking to capitalize on consumers’ perception of coffee as a snack. The chain has been rolling out iced coffee across the country since spring and is testing specialty coffee, including some frozen-coffee beverages, in select markets.

“It has been extremely popular,” said Marta Fearon, director of McDonald’s U.S. marketing. “It is exceeding expectations.”

The Snack Wrap, which features grilled or crispy chicken wrapped in a flour tortilla, also is performing well.

Introduced in August 2006, the Snack Wrap has been so successful that McDonald’s added a chipotle BBQ flavor in July to complement the existing ranch and honey mustard options. While Fearon declined to offer specific details, she said the wrap is doing well at all times of the day, particularly after 9 p.m.

“Snacking will probably continue to be looked at,” Fearon said. “You’ll see more from McDonald’s.”

From indulgent sweets to savory treats, Canton, Mass.-based Dunkin’ Donuts has been exploring a variety of options to fulfill consumers’ growing snack cravings and boost sales.

Among Dunkin’s most popular snack options is a line of frozen drinks first introduced in April 2006. The chain, which has nearly 5,400 U.S. units, expanded its smoothie line in June by adding the Sobe Energy Coolatta, a cherry-citrus-flavored beverage aimed at on-the-go consumers.

“Smoothies have been great for us,” said Stan Frankenthaler, executive chef and director of culinary development for Dunkin’ Brands. “I think what customers like now is the opportunity to layer on.”

To meet consumers’ desire to have a one-, two- or three-item snack, Dunkin’ recently began testing such options as handheld hash browns and flat-bread sandwiches.

“[We’re trying to give consumers] the right kind of comfort foods, with a Dunkin’ twist,” Frankenthaler said.

Similarly, Emeryville, Calif.-based Jamba Juice, known for its healthful smoothies and good-for-you snacks, is adding more snack options to complement its signature smoothies.

“Right now we are doing a baked-goods snack review,” said Kristel Cerna, Jamba Juice’s director of product marketing. “On the packaged goods side, we’re looking for things that round out the nutrition in a smoothie [like] nuts, protein, water.”

Currently, the chain, which has 650 U.S. stores, offers more than 25 smoothie options, including a newly launched line of Functional smoothies designed to meet specific health and lifestyle needs; six to 10 baked goods such as toasted pretzels, jalapeño twists and protein pizza sticks; and about 10 prepackaged, single-serve snacks such as soy chips, cheddar puffs and protein bars.

Snacks increasingly are paying off for Jamba. Cerna said business is up at both midmorning and afternoon snack time, with afternoon snacks accounting for about 30 percent of all business.

“It’s a healthy daypart for us,” Cerna said.