This is part of the Nation’s Restaurant News annual Top 100 report, a proprietary ranking of the foodservice industry’s largest restaurant chains and parent companies.

This is part of the Nation’s Restaurant News annual Top 100 report, a proprietary ranking of the foodservice industry’s largest restaurant chains and parent companies.

It’s pretty simple: The fewer restaurants your company operates, the lower the revenue they generate.

This was made abundantly clear in the Latest Year. Many companies refranchised units as they sought to improve their standing with shareholders. Others closed locations amid weakening financials in a generally difficult year for sales.

To wit: The Wendy’s Co. generated $1.3 billion in the Latest Year, down 25.3 percent from the year before.

To wit: The Wendy’s Co. generated $1.3 billion in the Latest Year, down 25.3 percent from the year before.

Wendy’s in recent years has opted to reduce its store ownership. The company sold 400 restaurants in 2014 and then completed the sale of another 500 locations last year. The Quick-Service brand ended the Latest Year owning less than 6 percent of its 5,739 U.S. locations.

Wendy’s was not the only one. Several companies saw revenue declines thanks largely to refranchising in the Latest Year, according to Nation’s Restaurant News’ Top 100 ranking of companies based on U.S. foodservice revenue.

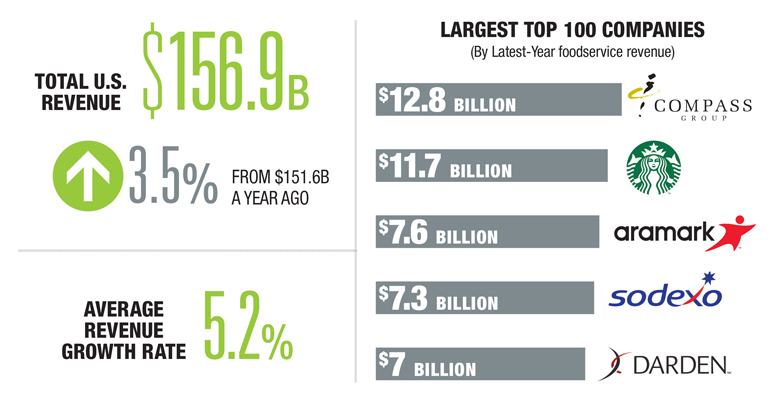

This ranking includes private-equity groups and other investment companies that own restaurants and other foodservice providers, such as cafeteria management companies. The largest, for instance, is the London-based food management company Compass Group PLC, which generated $12.8 billion in foodservice revenue in its Latest Year.

Restaurant brands have been reducing the number of stores they operate for years, reducing their own foodservice revenue in exchange for more profitable revenue from franchising.

In the Latest Year, 76 percent of the 200,165 units in the Top 100 were franchisee-owned, up from 75 percent two years earlier.

In many cases, shareholders are pushing franchising as a strategy to help improve company margins at times of sales and stock price challenges. Wendy’s started its refranchising strategy, known as “system optimization,” shortly after selling Arby’s.

Another company refranchising is Wendy’s competitor McDonald’s Corp., where foodservice revenues declined 7.5 percent, to just under $5.1 billion, largely thanks to the company’s refranchising efforts.

McDonald’s, working to recover from a three-year sales slide, has opted to refranchise many of its company locations in a bid to franchise 95 percent of its nearly 37,000 global locations. The Oak Brook, Ill.-based burger giant has sold 397 U.S. company stores to franchisees since the end of 2014.

Carl’s Jr. and Hardee’s, meanwhile, have been refranchising locations since 2014, too. The burger chains have refranchised more than 600 locations since then, and now operate a combined 237 of their chains’ more than 3,000 locations.

Partially as a result, Hardee’s-Carl’s owner Roark Capital Group’s foodservice revenue declined to $2.9 billion in the Latest Year, from $3.1 billion the year before — even though the company bought Jimmy John’s in October.

Likewise, TGI Fridays refranchised many of its locations, having gone from operating 200 locations two years ago to 54 in the Latest Year, out of 469 total locations.

Refranchising also had the opposite affect, leading to revenue growth at many franchisee companies. The Briad Group, operator of TGI Fridays and Wendy’s, saw revenue grow 11.3 percent in part due to a pair of Wendy’s acquisitions.

Multi-concept franchisee Sun Holdings LLC grew revenue 15.3 percent in the Latest Year, and 21.8 percent the Preceding Year, largely due to a242-unit increase in locations, to 578, between the ends of 2014 and 2016. Some of those new locations came through refranchising deals with various chains.

Store closures have also played a role in companies’ revenue in the Latest Year. Ruby Tuesday, for instance, closed 99 of 646 company-operated locations in its Latest-Year first quarter, alone. That, plus weak sales at the bar-and-grill chain, led to a more than 15-percent decline in company foodservice revenue in the Latest Year.

Similarly, foodservice revenue at Bob Evans Farms Inc. declined 8 percent in part because of closures at its Bob Evans Restaurants chain. Of course, Bob Evans Farms is getting out of the business altogether, having sold the restaurant chain to Golden Gate.

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @JonathanMaze