Digital innovations pepper the foodservice landscape, but four brands stand out for their ability to bend the curve in information technology.

Starbucks was early in its use of a loyalty program layered into mobile smartphones. Chili’s Grill & Bar was an early adopter of tabletop tablets. Domino’s pioneered online ordering, with those transactions now accounting for 50 percent of orders in the U.S. And Taco Bell spent years developing an industry-leading mobile ordering and payment app.

Former Taco Bell CEO Greg Creed, now CEO of parent company Yum! Brands Inc., said last month that the company would continue to invest in technology to keep its brands competitive.

“This is important because digital orders provide customers with the superior order experience,” he said, “and generate higher average spend.”

Kevin Johnson, Starbucks’ president and chief operating officer, said the company is proud of the difference the technology is making in its customers’ lives.

“Customer connection has always been core to who we are as a company,” Johnson added, “and we are leveraging the digital assets to expand and enhance that customer connection to what is now more than 16 million active users of our mobile apps in the U.S. alone.”

In significantly less than a decade, digital innovations have dramatically altered how U.S. restaurants do business. Take a look at four leaders in the digital revolution.

Chili's Grill & Bar

Project: Tabletop tablets

KPI: Number of tablet surveys completed; number of payments

What’s next: Tablet-based loyalty program

In just two years, tabletop tablets have nearly become a fixture in casual dining, as operators look to give customers more flexibility and reduce time in the restaurants and dependence on waitstaff.

Chili’s Grill & Bar, the 1,580-unit division of Dallas-based Brinker International Inc., was the first major casual-dining chain to adopt the devices, launching its program in September 2013. Many brands have followed suit.

Besides giving customers the options to order and pay without consulting waitstaff, Chili’s has found more instances of valuable customer feedback provided through short surveys on the tablets.

Tech timeline

September 2013: Chili’s announces that it is working with Ziosk and other providers to bring tabletop tablets to all company-owned restaurants nationwide.

April–August 2014: Chili’s conducts a multi-market, five-month test of tabletop technologies and, after evaluation, makes the decision to deploy Ziosk.

June 2014: Chili’s begins the rollout to company-owned stores in the U.S., installing more than 45,000 tablets in 823 restaurants.

December 2014: Chili’s completes rollout to the franchised system.

March 2015: Chili’s begins testing its new My Chili’s Rewards loyalty program, layering in redemption of American Express points rewards for customers who participate in that credit card program. Customers can swipe an AmEx card on the tablet to redeem those points. Guests can sign up for the loyalty program on their smartphone or through the tablet devices.

Next steps

This month, Chili’s will roll out the loyalty program to the rest of its system.

“This program provides a fully digital experience where guests can use their mobile phone, our website or our [tablet] to sign up for the program and track their points, and they can use the Ziosk to redeem their points when they dine with us,” said Wyman Roberts, CEO and president of Brinker. “Our focus is to drive incremental business, so we leverage guest feedback to craft a program that delivers what matters most to them.”

Domino's

Project: Online ordering

KPI: Growth in percentage of online orders

What’s next: Ordering apps on wearable devices like watches.

When it comes to online ordering, Ann Arbor, Mich.-based Domino’s has become a leader since first introducing the service in 2007.

And more recently, Domino’s CEO Patrick Doyle has put an emphasis on Domino’s and its technology offerings. He told the Detroit Free Press in January that the information technology “area of our business is only going to continue to grow.”

“We’ve got over 200 people working here now in technology,” Doyle said. “That’s over a third of our workforce here in Ann Arbor, and that’s going to continue to grow.”

And the company makes that investment because online customers order a little bit more than other patrons, Doyle said, and their satisfaction scores and frequency of purchases are also higher.

“One of those connection points is certainly technology and our leadership position of unmatched innovation continues to evolve the brands and revolutionize the Domino’s customer experience,” Doyle said in an April earnings call. “About 50 percent of our sales in the U.S. now come via digital ordering channels.” And in international markets, that number is about 40 percent, he said.

“We continue to collaborate and share best practices around the world to help more markets reach their full digital capability,” Doyle said.

Here’s how Domino’s wove its way onto the web early and maintained its leadership position:

1996: Domino’s launches its first website, www.dominos.com, in a year it had then-record sales of $2.8 billion systemwide for just more than 1,000 stores.

2007: Domino’s begins offering online ordering for pizza delivery.

2008: Domino’s launches its Pizza Builder and Domino’s Tracker, technology that allows customers to follow the progress of their orders online from the time they click the “Place Order” button or hang up the telephone until the delivery person knocks on the door.

2011: Domino’s introduces an ordering app for the iPhone.

2012: Domino’s debuts an ordering app for Android devices, bringing its technology to 80 percent of smartphones, and also for Amazon’s Kindle Fire.

2013: Domino’s updates Domino’s Tracker with functions for customers who order Handmade Pan Pizzas. And the company launches a pilot program, now discontinued, in one Salt Lake City, Utah, store that lets customers watch their orders being made live via a webcam. The company also allows customers to create Pizza Profiles, which saves information and records prior orders so they can order in five clicks.

2014: Domino’s unveils its ordering app for the automobile-based Ford SYNC AppLink System. Customers who have a Pizza Profile on their Domino’s mobile app, as well as the Ford SYNC in-car connectivity system, can place their saved “Easy Order” in just a few simple, voice-activated steps.

Domino’s also launches an online group ordering tool which makes ordering pizza for large parties and group gatherings easy at most of its now 11,000 stores.

June 2014: Domino’s kicks off voice-recognition ordering, its version of Apple’s Siri but called “Dom,” for its iPhone and Android apps. January 2015: Domino’s, before the highly watched Super Bowl, introduces Domino’s Tracker to Samsung Smart TVs.

Next steps

Domino’s is rolling out new web-based ordering platforms, especially for the growing number of wearable devices such as Pebble and Android Wear smart watches and likely the new Apple Watch. Mike Lawton, Domino’s chief financial officer, said in April’s earnings call that the best uses of technology in the category are those that are “giving customers a better experience.”

Starbucks

Project: Loyalty

KPI: Growth in number of My Starbucks Rewards members

What’s next: Targeted loyalty rewards

When it comes to creating a bond with customers, Starbucks knows what it’s doing. The Seattle-based chain, with 22,088 locations globally, has turned the My Starbucks Rewards platform into a consumer loyalty behemoth with 10 million members as of April.

The loyalty program is now seamlessly incorporated into the Starbucks smartphone app, in which customers accrue “stars” for purchases. Starbucks said about 16 million customers now use the mobile payment app.

“Each new member represents a deeper more personalized customer relationship,” said Kevin Johnson, Starbucks’ president and chief operating officer. “And more personalized customer relationships allow us to better serve customers and grow our business.”

Tech timeline

September 2009: Starbucks launches the Starbucks Card mobile loyalty app for iPhone and iPod Touch, and tests mobile payments in 16 stores in Seattle and California.

Starbucks expands the mobile payment test to nearly 300 company-operated stores in New York City and Long Island, N.Y.

January 2011: The national rollout of Starbucks mobile payment and loyalty hits nearly 6,800 U.S. company-operated stores.

June 2011: The Starbucks app for Android debuts and the chain announces a mobile payment rollout at nearly 1,000 Starbucks locations in Safeway stores.

July 2012: Starbucks expands mobile payment on Android app to international markets.

March 2014: The iPhone app gets a complete redesign, including a “shake-to-pay” feature and digital tipping. The Android redesign follows in September 2014.

December 2014: Starbucks pilots mobile ordering and payment in Portland, Ore., which allows for placing and paying for orders before visiting a coffeehouse. The feature is expected to be available nationally this year.

Next steps

Matt Ryan, global chief strategy officer at Starbucks, said tests of mobile ordering and payments are fueling growth in the My Starbucks Rewards program.

“The ability to become more and more targeted and send more offers to the right person at the right time in the way that they want it, is the capability we have been growing here,” Ryan said. “It’s going to be an enormous long-run play for us.”

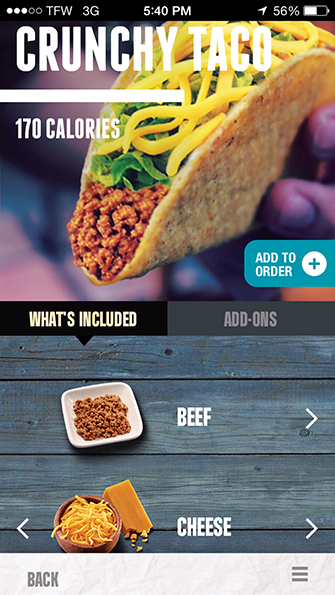

Taco Bell

Project: Mobile ordering

KPI: Number of app downloads

What’s next: Loyalty; tablet or desktop ordering

Taco Bell, the 6,000-unit Irvine, Calif.-based division of Yum! Brands Inc., shook up the quick-service restaurant digital world last October when it introduced the “Live Mas” mobile order and payments app.

The brand knew that its youthful customers relied on their smartphones probably more than any other demographic group.

“For these kids, it’s not whether you have a smartphone; it’s which smartphone do you have,” Jeff Jenkins, mobile lead for Taco Bell, told Nation’s Restaurant News at the time.

“Mobile is the biggest shift in QSR since the drive-thru,” Jenkins said. “If you can get 10 million people to download your app, you’re putting a portal to Taco Bell in 10 million pockets.”

Andy Barish, a securities analyst with Jefferies Equity Research, said of the app launch: “Taco Bell has one of the best customer engagement strategies in the industry and has truly cultivated a lifestyle brand among Millennials.”

Tech timeline

2011: Taco Bell begins developing its mobile-ordering app.

2013: The app begins beta-tests in five locations. The platform enables not only mobile ordering, but also the ability to customize orders. Soon it will feature mobile loyalty, e-gifting, gift card payments and integration with social networks.

October 2014: Taco Bell introduced the “Live Mas” new mobile ordering app systemwide, allowing customers to order and pay for food with a few taps and swipes of a smartphone.

January 2015: Taco Bell incentivizes downloads of its app by offering free Doritos Locos Tacos during the month, up to one million tacos, with each mobile purchase.

Next steps

Look for similar “Live Mas” functionalities for tablet computers and desktop devices. Greg Fancher, Taco Bell’s chief information officer, told NRN last fall that the chain sees mobile as a platform on which to build.

“We’re looking at scale and flexibility,” he said. “We’re focused on mobile now, but preparing for what happens next.”

That could include creating similar systems specifically for tablets or desktop devices and ties to a loyalty program, Jenkins said.

“Loyalty is a really interesting opportunity for QSR,” he said. “We’re trying to bring something to life.”

Contact Ron Ruggless at [email protected].

Follow him on Twitter: @RonRuggless