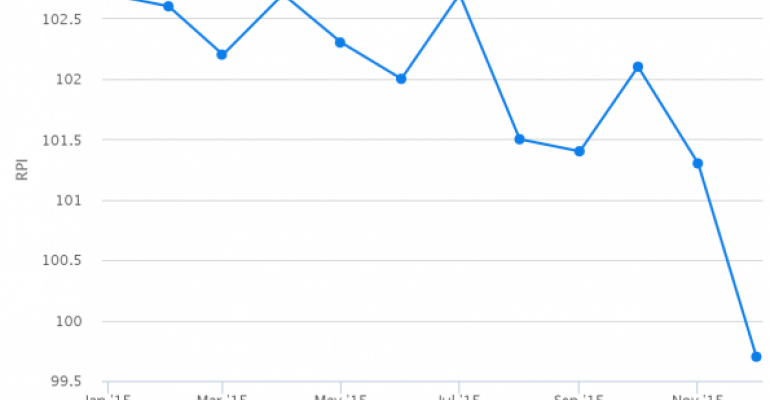

The restaurant industry contracted in December for the first time in nearly three years due to flagging sales and mounting economic worries, according to the latest Restaurant Performance Index from the National Restaurant Association.

The Restaurant Performance Index measured 99.7 in the association’s monthly analysis of the state of the restaurant industry, below the 100 mark that the NRA considers to indicate growth, for the first time since February 2013.

Growing economic concerns toward the end of the year were likely to blame for the sudden drop in the index, which fell 1.6 percentage points from November. Operators reported a net decline in same-store sales for the month for the first time in nearly three years.

“Elements of the economy remained uncertain toward the end of 2015, which is reflected in the RPI and restaurant operators’ less optimistic outlook,” said Hudson Riehle, senior vice president of research at the National Restaurant Association.

“Restaurateurs are facing a range of headwinds in the operating environment, and while some signs are trending in a positive direction, several others remain less promising,” he added. “The sustained period of moderate economic growth and its regional variations in particular is taking a toll on operators’ psyche.”

The performance index has two components: A Current Situation Index that rates current sales and expansion, and an Expectations Index that analyzes operators’ outlook for the next six months. The index is based on the association’s Restaurant Industry Tracking Survey, fielded monthly among 400 restaurant operators on a variety of indicators.

The Current Situation Index fell to 99.4 in December, from 100.9 in November, the first time since February 2014 that the index was below 100.

The results were due to the poor sales. The NRA said that 42 percent of operators reported a same-store sales gain in December, while 43 percent reported a decline.

Operators also reported a net decline in customer traffic during the month. Only 33 percent of operators reported an increase in customer traffic during the month, while 51 percent reported a decline. That was the softest traffic result since January 2014.

Expectations, meanwhile, were only slightly higher than sales results, but they are still at their dimmest level in the post-recessionary era.

Only 27 percent of restaurant operators expect higher sales in six months, falling from 38 percent the previous month, and the lowest level in six years. Twelve percent of operators expect sales volume to be lower in six months than in the previous year, while 61 percent expect sales to remain the same.

Operators are also pessimistic about the overall direction of the economy. Only 12 percent expect economic conditions to improve, while 25 percent expect conditions to worsen.

Restaurateurs scaled back plans for capital expenditures as a result. Fifty-two percent of operators plan to make a capital expenditure for equipment or expansion in the next six months, falling from 63 percent the previous month.

As a result, the Expectations Index was 100.1 in December, declining 1.6 percent from November.

Contact Jonathan Maze at [email protected]

Follow him on Twitter: @jonathanmaze