The government shutdown and budget crisis in Washington took a toll on the restaurant industry in September, as wary consumers cut back on spending, according to the latest NRN-MillerPulse survey.

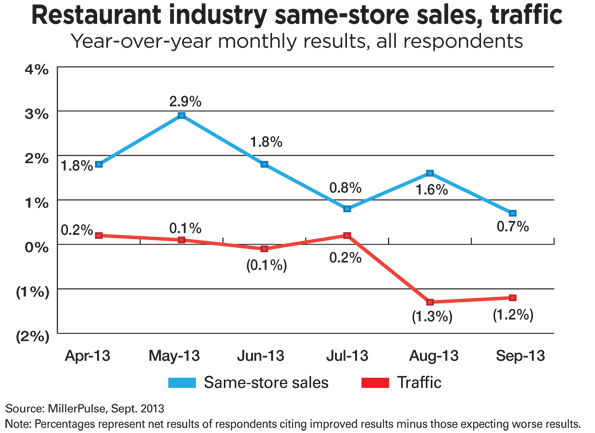

Restaurant same-store sales increased only 0.7 percent in September, the worst performance since a 1.8-percent decline in February, according to the monthly survey of about 55 restaurant operators around the U.S., who represent more than $40 billion in sales combined. Traffic remained negative, decreasing 1.2 percent industry-wide.

RELATED

• Stagnant August restaurant sales dampen operator outlook

• Casual dining, QSR sales performance gap widens

• MillerPulse at NRN.com

September’s lackluster results put “an exclamation point on a crappy quarter,” said Larry Miller, a former Wall Street securities analyst and founder and chief executive of the MillerPulse report.

Miller blamed September’s results on the uncertainty created by the “political theater” in Washington, as lawmakers came to loggerheads over the debt ceiling, funding the Affordable Care Act and the resulting government shutdown.

“As the government and the media focused more on the shutdown, people got a little more cautious about their spending,” he said, noting that sales trends took a deeper dive toward the end of the month as the government shutdown loomed.

“We saw similar drops in average check indicators during the last debt ceiling debate” in 2011, added Miller. “We saw the same drop-off in dessert, appetizer and alcohol sales. Fortunately it snapped back pretty quickly two or three months later.”

In addition to weak sales and traffic, operators also saw check averages erode, including softer alcohol, appetizer and dessert sales. A net 19 percent of operators surveyed saw alcohol sales decline in September, compared with a net 12.5 percent of operators reporting an increase in alcohol sales in August.

On a two-year basis, same-store sales slowed in September to 3.1 percent, from 4.4 percent in August, the report said.

All segments weakened in September compared with August, but the fast-food sector remained the strongest, with a same-store sales increase of 3 percent, though that was a decline from 3.7 percent in August.

Casual dining suffered the most, with a 0.3-percent decline in same-store sales, down from an increase of 0.2 percent in August.

The fast-casual sector saw same-store sales increase only 0.2 percent, compared with 1.9 percent in August. Fine dining same-store sales rose only 0.9 percent, compared with a 2.3-percent increase in August.

Only the fast-food segment saw traffic increase, rising 0.8 percent in September. Traffic at casual-dining restaurants fell 1.1 percent, and dropped 2.5 percent among fast-casual restaurants. Fine dining reported a 3-percent decline in traffic.

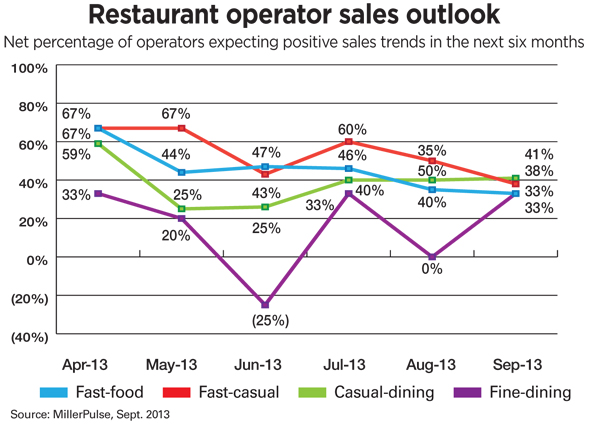

Still, operators indicated that they expect sales to improve over the next six months, although sentiment on sales was lower than last month for quick-service operators, which in the report includes both fast food and fast casual. The exception was in the fine-dining segment, where most operators expected the situation to remain the same, the report found.

Fifty-four percent of those surveyed said their outlook for October is positive, compared with 22 percent who expect trends to get worse.

MillerPulse, an exclusive partner with Nation’s Restaurant News, is a leading provider of industry performance data.

Register for MillerPulse at millerpulse.com

Contact Lisa Jennings at [email protected].

Follow her on Twitter: @livetodineout