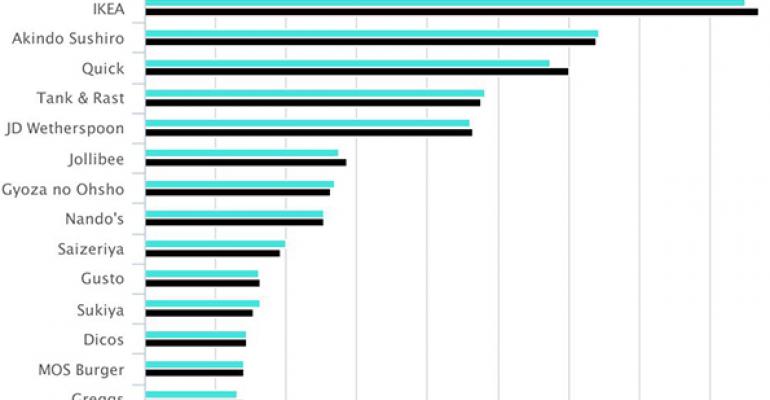

The concepts fielded by this year’s International Top 25 chains and their estimated sales per unit, or ESPU, range from the large-scale small-pub Enterprise Inns system of Solihull, England, to in-store cafeteria operator IKEA of Delft, Netherlands.

With 5,300 locations at year-end, Enterprise Inn had a 2014 ESPU of $193,000 and IKEA, with 357 units, had an ESPU of $4.3 million.

ESPU is a proprietary Nation’s Restaurant News metric calculated using Euromonitor International supplied actual, estimated or projects sales and unit data. It is intended to portray the approximate unit-level output across an entire system in any given year and so may differ from reported qualified average unit volume numbers or same-store sales figures that reflect just the output from a certain class of location, such as those separated by age or size or latest concept prototype.

As a group, International Top 25 chains increased their 2014 ESPUs by an average of 1.8 percent, and had an average ESPU of $1.2 million. For comparison purposes, the Top 25 chains ranked by United States system sales as part of NRN’s annual Top 200 census had latest-year average growth in ESPU of 3.7 percent, and an average ESPU of $1.7 million.

Japanese donut market leader Mister Donut of Osaka achieved the highest rate of ESPU growth within the International Top 25, 18.4 percent. The biggest fall off — a decrease of 5.9 percent — came at c-store operator Lawson of Tokyo. With 2014 foodservice sales of $5.4 billion, Lawson is the second largest chain on the International Top 25 roster behind 7-Eleven.

Mister Donut’s rising estimated sales per unit, which reached $413,800 in 2014, likely was a result of multiple developments, including the closing of under performing units; recipe reformulations; the creation of new specialty pastries for the regular menu and seasonal offers; and the reduction of in-store production batch sizes to shorten holding times and yield fresher products. But while Mister Donut is seeing rising store-level output, sales of its core product could come under intense pressure from 7-Eleven’s aggressive move into the donut space that began with tests in 2014 and became a full-blown rollout in Japan beginning this year. 7-Eleven strategy could harm the much smaller Mister Donut if it leads to cannibalization among donut eaters instead of adding new customers to eat more donuts, some market watchers have speculated.

Among multi-chain segments, the three-chain, limited-service restaurant/bakery products segment had the lowest average estimated sales per unit in 2014, at $550,900. But the limited-service restaurant/bakery products group, in large part because of the performance by Mister Donut, also saw the greatest year-over-year growth in segment average ESPU in 2014, with an 8.2-percent improvement.

In contrast, the three-chain, casual-dining segment, with a 2014 average ESPU of $1.0 million, showed the greatest year-over-year decrease in average segment ESPU, or a decline of 1.5 percent. Only Tokyo-based, Japanese and Western foods purveyor Gusto, with a 1.1-percent uptick in its 2014 ESPU, to $819,500, was in positive territory for that metric.

The three-chain limited-service restaurant/Asian food segment, with an average 2014 ESPU of $1.6 million, which was down 1.5 percent from a year earlier, scored the highest average ESPU compared with other multi-chain segments.

That high limited-service restaurant/Asian food segment segment average estimated sales per unit masked the wide range of underlying performances among its members. That group’s 2014 ESPUs ranged from $696,100 at rice-and-beef bowl specialist Yoshinoya of Tokyo, to $3.2 million at affordable conveyor belt sushi seller Akindo Sushiro of Osaka, Japan.

Contact Alan J. Liddle at [email protected]

Follow him on Twitter: @AJ_NRN