October proved to be a relatively good month for the restaurant industry as measured by same-store sales and traffic, but there are also signs that the growth could be short-lived, according to the latest Restaurant Industry Snapshot results.

The Restaurant Industry Snapshot for October, published by Black Box Intelligence and People Report, shows positive same-store sales growth for the second consecutive month. Same-store traffic, albeit still negative, has now shown four consecutive months of improvement when compared with the previous month’s results.

RELATED

• 3Q restaurant sales, traffic reflect economic uncertainty

• Report: Restaurant sales fall in August, consumers still optimistic

• Sales & Sentiment Tracker at NRN.com

Same-store sales rose 1.0 percent for October, a significant improvement over the 0.1-percent result reported for September. October’s results reflect the largest monthly increase in same-store sales reported since March of 2013. In addition, the three-month rolling average of same-store sales growth was 0.3 percent in October, the first time this metric has posted positive growth since July.

“Although the October results might be easily considered as very optimistic signs for the industry, these should be put in the context of what was happening throughout vast regions of the country at the end of October last year as hurricane Sandy hit our shores,” commented Victor Fernandez, executive director of insights and knowledge for Black Box Intelligence and People Report. “In fact, for the last week of October 2013, the regions most affected by the storm (Mid-Atlantic, New York-New Jersey, and New England) all reported same-store sales above 3.0 percent. However, isolating the effect of the ‘Superstorm,’ we believe there were actual positive results during October for the industry, as, according to our metrics, each of the four weeks of the month posted positive same-store sales.”

Traffic in comparable stores fell 1.4 percent for October, an improvement of 0.5 percent from the value reported for September and the highest traffic growth rate reported since November 2011. “The industry continues to have a guest-count problem, but the latest results show very positive signs regarding same-store traffic growth,” noted Fernandez.

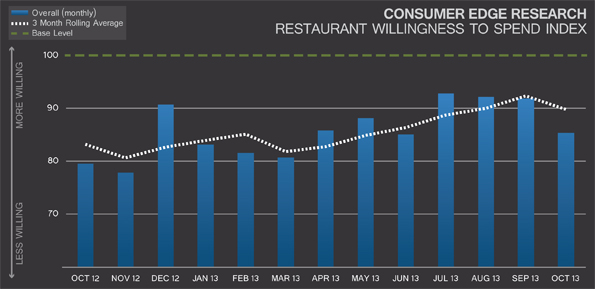

However, the Restaurant Willingness to Spend Index from Consumer Edge Research registered a value of 86 during the last month — a drop of six points from the value reported for September and the biggest decrease in the value of this index since March. “This tumble coupled with the fall in overall consumer confidence experienced during October might indicate that the strong improvements seen during the month may be short-lived,” warned Fernandez.

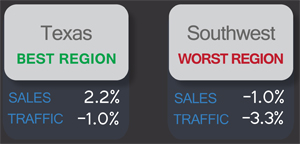

From a regional standpoint, Texas reported the best performance in October, with 2.2-percent growth in same-store sales and a 1.0-percent decline in traffic. The Southwest region reported the worst performance, with same-store sales falling 1.0 percent and traffic declining 3.3 percent. The Mid-Atlantic region, which had seen the worst regional results over the last five months, showed very positive results during the last week of the month, primarily due to the soft sales a year ago as a result of the storm.

The overall improvement in same-store sales seen at the national level also translated into improvements at the individual market level; 125 of the 182 DMAs covered by Black Box Intelligence posted positive growth in comparable stores during September, compared to only 99 DMAs reporting positive sales growth the previous month.

According to the latest numbers published by People Report, turnover at both the restaurant hourly and management level has increased during the first nine months of the year when compared with 2012. However, for the second consecutive month, there was a decrease in rolling 12-month turnover for restaurant managers.

Job growth continues to show positive signs for the industry, as September posted a 1.9-percent increase in headcount year-over-year. This latest result represents an increase from the 1.1-percent and 1.4-percent annual growth reported for August and July, respectively.

The Restaurant Industry Snapshot is a compilation of real sales and traffic results from over 180 DMAs from 100+ restaurant brands and approximately 16,000+ restaurants that are clients of Black Box Intelligence. Currently, data is reported in four distinct segments: casual dining, upscale/fine-dining, fast casual, and family dining. Black Box Intelligence is a sister company to People Report, which tracks the workforce analytics of one million restaurant employees. The Restaurant Industry Snapshot also includes the Restaurant Industry Willingness to Spend Index from Consumer Edge Research, which is a monthly household survey of more than 2,500 consumers. Consumer Edge Insights is a marketing partner with Black Box Intelligence and People Report.